3.4 — Multivariate OLS Estimators

ECON 480 • Econometrics • Fall 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/metricsF20

metricsF20.classes.ryansafner.com

The Multivariate OLS Estimators

The Multivariate OLS Estimators

- By analogy, we still focus on the ordinary least squares (OLS) estimators of the unknown population parameters β0,β1,β2,⋯,βk which solves:

min^β0,^β1,^β2,⋯,^βkn∑i=1[Yi−(^β0+^β1X1i+^β2X2i+⋯+^βkXki)⏟ui]2

- Again, OLS estimators are chosen to minimize the sum of squared errors (SSE)

- i.e. sum of squared distances between actual values of Yi and predicted values ^Yi

The Multivariate OLS Estimators: FYI

Math FYI: in linear algebra terms, a regression model with n observations of k independent variables:

Y=Xβ+u

(y1y2⋮yn)⏟Y(n×1)=(x1,1x1,2⋯x1,nx2,1x2,2⋯x2,n⋮⋮⋱⋮xk,1xk,2⋯xk,n)⏟X(n×k)(β1β2⋮βk)⏟β(k×1)+(u1u2⋮un)⏟u(n×1)

The Multivariate OLS Estimators: FYI

Math FYI: in linear algebra terms, a regression model with n observations of k independent variables:

Y=Xβ+u

(y1y2⋮yn)⏟Y(n×1)=(x1,1x1,2⋯x1,nx2,1x2,2⋯x2,n⋮⋮⋱⋮xk,1xk,2⋯xk,n)⏟X(n×k)(β1β2⋮βk)⏟β(k×1)+(u1u2⋮un)⏟u(n×1)

- The OLS estimator for β is ˆβ=(X′X)−1X′Y 😱

The Multivariate OLS Estimators: FYI

Math FYI: in linear algebra terms, a regression model with n observations of k independent variables:

Y=Xβ+u

(y1y2⋮yn)⏟Y(n×1)=(x1,1x1,2⋯x1,nx2,1x2,2⋯x2,n⋮⋮⋱⋮xk,1xk,2⋯xk,n)⏟X(n×k)(β1β2⋮βk)⏟β(k×1)+(u1u2⋮un)⏟u(n×1)

- The OLS estimator for β is ˆβ=(X′X)−1X′Y 😱

- Appreciate that I am saving you from such sorrow 🤖

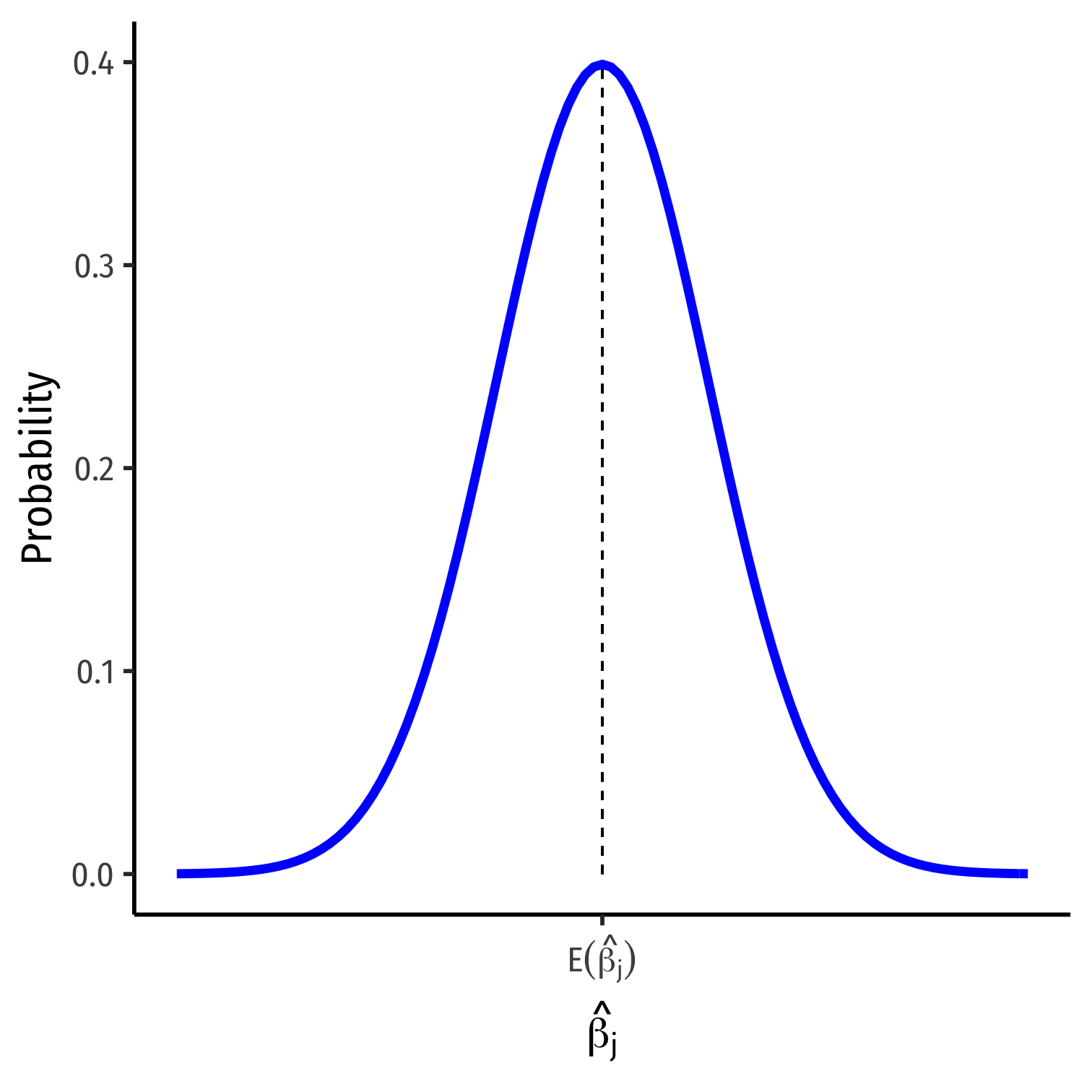

The Sampling Distribution of ^βj

- For any individual βj, it has a sampling distribution:

^βj∼N(E[^βj],se(^βj))

- We want to know its sampling distribution’s:

- Center: E[^βj]; what is the expected value of our estimator?

- Spread: se(^βj); how precise or uncertain is our estimator?

The Sampling Distribution of ^βj

- For any individual βj, it has a sampling distribution:

^βj∼N(E[^βj],se(^βj))

- We want to know its sampling distribution’s:

- Center: E[^βj]; what is the expected value of our estimator?

- Spread: se(^βj); how precise or uncertain is our estimator?

The Expected Value of ^βj: Bias

Exogeneity and Unbiasedness

- As before, E[^βj]=βj when Xj is exogenous (i.e. cor(Xj,u)=0)

Exogeneity and Unbiasedness

As before, E[^βj]=βj when Xj is exogenous (i.e. cor(Xj,u)=0)

We know the true E[^βj]=βj+cor(Xj,u)σuσXj⏟O.V. Bias

Exogeneity and Unbiasedness

As before, E[^βj]=βj when Xj is exogenous (i.e. cor(Xj,u)=0)

We know the true E[^βj]=βj+cor(Xj,u)σuσXj⏟O.V. Bias

If Xj is endogenous (i.e. cor(Xj,u)≠0), contains omitted variable bias

Exogeneity and Unbiasedness

As before, E[^βj]=βj when Xj is exogenous (i.e. cor(Xj,u)=0)

We know the true E[^βj]=βj+cor(Xj,u)σuσXj⏟O.V. Bias

If Xj is endogenous (i.e. cor(Xj,u)≠0), contains omitted variable bias

We can now try to quantify the omitted variable bias

Measuring Omitted Variable Bias I

- Suppose the true population model of a relationship is:

Yi=β0+β1X1i+β2X2i+ui

- What happens when we run a regression and omit X2i?

Measuring Omitted Variable Bias I

- Suppose the true population model of a relationship is:

Yi=β0+β1X1i+β2X2i+ui

What happens when we run a regression and omit X2i?

Suppose we estimate the following omitted regression of just Yi on X1i (omitting X2i):†

Yi=α0+α1X1i+νi

† Note: I am using α's and νi only to denote these are different estimates than the true model β's and ui

Measuring Omitted Variable Bias II

- Key Question: are X1i and X2i correlated?

Measuring Omitted Variable Bias II

Key Question: are X1i and X2i correlated?

Run an auxiliary regression of X2i on X1i to see:†

X2i=δ0+δ1X1i+τi

Measuring Omitted Variable Bias II

Key Question: are X1i and X2i correlated?

Run an auxiliary regression of X2i on X1i to see:†

X2i=δ0+δ1X1i+τi

If δ1=0, then X1i and X2i are not linearly related

If |δ1| is very big, then X1i and X2i are strongly linearly related

† Note: I am using δ's and τ to differentiate estimates for this model.

Measuring Omitted Variable Bias III

- Now substitute our auxiliary regression between X2i and X1i into the true model:

- We know X2i=δ0+δ1X1i+τi

Yi=β0+β1X1i+β2X2i+ui

Measuring Omitted Variable Bias III

- Now substitute our auxiliary regression between X2i and X1i into the true model:

- We know X2i=δ0+δ1X1i+τi

Yi=β0+β1X1i+β2X2i+uiYi=β0+β1X1i+β2(δ0+δ1X1i+τi)+ui

Measuring Omitted Variable Bias III

- Now substitute our auxiliary regression between X2i and X1i into the true model:

- We know X2i=δ0+δ1X1i+τi

Yi=β0+β1X1i+β2X2i+uiYi=β0+β1X1i+β2(δ0+δ1X1i+τi)+uiYi=(β0+β2δ0)+(β1+β2δ1)X1i+(β2τi+ui)

Measuring Omitted Variable Bias III

- Now substitute our auxiliary regression between X2i and X1i into the true model:

- We know X2i=δ0+δ1X1i+τi

Yi=β0+β1X1i+β2X2i+uiYi=β0+β1X1i+β2(δ0+δ1X1i+τi)+uiYi=(β0+β2δ0⏟α0)+(β1+β2δ1⏟α1)X1i+(β2τi+ui⏟νi)

- Now relabel each of the three terms as the OLS estimates (α's) and error (νi) from the omitted regression, so we again have:

Yi=α0+α1X1i+νi

Measuring Omitted Variable Bias III

- Now substitute our auxiliary regression between X2i and X1i into the true model:

- We know X2i=δ0+δ1X1i+τi

Yi=β0+β1X1i+β2X2i+uiYi=β0+β1X1i+β2(δ0+δ1X1i+τi)+uiYi=(β0+β2δ0⏟α0)+(β1+β2δ1⏟α1)X1i+(β2τi+ui⏟νi)

- Now relabel each of the three terms as the OLS estimates (α's) and error (νi) from the omitted regression, so we again have:

Yi=α0+α1X1i+νi

- Crucially, this means that our OLS estimate for X1i in the omitted regression is:

α1=β1+β2δ1

Measuring Omitted Variable Bias IV

α1=β1 + β2δ1

- The Omitted Regression OLS estimate for X1i, (α1) picks up both:

Measuring Omitted Variable Bias IV

α1=β1 + β2δ1

- The Omitted Regression OLS estimate for X1i, (α1) picks up both:

- The true effect of X1 on Yi: (β1)

Measuring Omitted Variable Bias IV

α1=β1 + β2δ1

- The Omitted Regression OLS estimate for X1i, (α1) picks up both:

- The true effect of X1 on Yi: (β1)

- The true effect of X2 on Yi: (β2)

- As pulled through the relationship between X1 and X2: (δ1)

Measuring Omitted Variable Bias IV

α1=β1 + β2δ1

- The Omitted Regression OLS estimate for X1i, (α1) picks up both:

- The true effect of X1 on Yi: (β1)

- The true effect of X2 on Yi: (β2)

- As pulled through the relationship between X1 and X2: (δ1)

- Recall our conditions for omitted variable bias from some variable Zi:

Measuring Omitted Variable Bias IV

α1=β1 + β2δ1

- The Omitted Regression OLS estimate for X1i, (α1) picks up both:

- The true effect of X1 on Yi: (β1)

- The true effect of X2 on Yi: (β2)

- As pulled through the relationship between X1 and X2: (δ1)

- Recall our conditions for omitted variable bias from some variable Zi:

1) Zi must be a determinant of Yi ⟹ β2≠0

Measuring Omitted Variable Bias IV

α1=β1 + β2δ1

- The Omitted Regression OLS estimate for X1i, (α1) picks up both:

- The true effect of X1 on Yi: (β1)

- The true effect of X2 on Yi: (β2)

- As pulled through the relationship between X1 and X2: (δ1)

- Recall our conditions for omitted variable bias from some variable Zi:

1) Zi must be a determinant of Yi ⟹ β2≠0

2) Zi must be correlated with Xi ⟹ δ1≠0

Measuring Omitted Variable Bias IV

α1=β1 + β2δ1

- The Omitted Regression OLS estimate for X1i, (α1) picks up both:

- The true effect of X1 on Yi: (β1)

- The true effect of X2 on Yi: (β2)

- As pulled through the relationship between X1 and X2: (δ1)

- Recall our conditions for omitted variable bias from some variable Zi:

1) Zi must be a determinant of Yi ⟹ β2≠0

2) Zi must be correlated with Xi ⟹ δ1≠0

- Otherwise, if Zi does not fit these conditions, α1=β1 and the omitted regression is unbiased!

Measuring OVB in Our Class Size Example I

- The “True” Regression (Yi on X1i and X2i)

^Test Scorei=686.03−1.10 STRi−0.65 %ELi

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | 686.0322487 | 7.41131248 | 92.565554 | 3.871501e-280 |

| str | -1.1012959 | 0.38027832 | -2.896026 | 3.978056e-03 |

| el_pct | -0.6497768 | 0.03934255 | -16.515879 | 1.657506e-47 |

Measuring OVB in Our Class Size Example II

- The “Omitted” Regression (Yi on just X1i)

^Test Scorei=698.93−2.28 STRi

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | 698.932952 | 9.4674914 | 73.824514 | 6.569925e-242 |

| str | -2.279808 | 0.4798256 | -4.751327 | 2.783307e-06 |

Measuring OVB in Our Class Size Example III

- The “Auxiliary” Regression (X2i on X1i)

^%ELi=−19.85+1.81 STRi

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | -19.854055 | 9.1626044 | -2.166857 | 0.0308099863 |

| str | 1.813719 | 0.4643735 | 3.905733 | 0.0001095165 |

Measuring OVB in Our Class Size Example IV

“True” Regression

^Test Scorei=686.03−1.10 STRi−0.65 %EL

“Omitted” Regression

^Test Scorei=698.93−2.28 STRi

“Auxiliary” Regression

^%ELi=−19.85+1.81 STRi

- Omitted Regression α1 on STR is -2.28

Measuring OVB in Our Class Size Example IV

“True” Regression

^Test Scorei=686.03−1.10 STRi−0.65 %EL

“Omitted” Regression

^Test Scorei=698.93−2.28 STRi

“Auxiliary” Regression

^%ELi=−19.85+1.81 STRi

- Omitted Regression α1 on STR is -2.28

α1=β1+β2δ1

- The true effect of STR on Test Score: -1.10

Measuring OVB in Our Class Size Example IV

“True” Regression

^Test Scorei=686.03−1.10 STRi−0.65 %EL

“Omitted” Regression

^Test Scorei=698.93−2.28 STRi

“Auxiliary” Regression

^%ELi=−19.85+1.81 STRi

- Omitted Regression α1 on STR is -2.28

α1=β1+β2δ1

The true effect of STR on Test Score: -1.10

The true effect of %EL on Test Score: -0.65

Measuring OVB in Our Class Size Example IV

“True” Regression

^Test Scorei=686.03−1.10 STRi−0.65 %EL

“Omitted” Regression

^Test Scorei=698.93−2.28 STRi

“Auxiliary” Regression

^%ELi=−19.85+1.81 STRi

- Omitted Regression α1 on STR is -2.28

α1=β1+β2δ1

The true effect of STR on Test Score: -1.10

The true effect of %EL on Test Score: -0.65

The relationship between STR and %EL: 1.81

Measuring OVB in Our Class Size Example IV

“True” Regression

^Test Scorei=686.03−1.10 STRi−0.65 %EL

“Omitted” Regression

^Test Scorei=698.93−2.28 STRi

“Auxiliary” Regression

^%ELi=−19.85+1.81 STRi

- Omitted Regression α1 on STR is -2.28

α1=β1+β2δ1

The true effect of STR on Test Score: -1.10

The true effect of %EL on Test Score: -0.65

The relationship between STR and %EL: 1.81

So, for the omitted regression:

−2.28=−1.10+(−0.65)(1.81)

Measuring OVB in Our Class Size Example IV

“True” Regression

^Test Scorei=686.03−1.10 STRi−0.65 %EL

“Omitted” Regression

^Test Scorei=698.93−2.28 STRi

“Auxiliary” Regression

^%ELi=−19.85+1.81 STRi

- Omitted Regression α1 on STR is -2.28

α1=β1+β2δ1

The true effect of STR on Test Score: -1.10

The true effect of %EL on Test Score: -0.65

The relationship between STR and %EL: 1.81

So, for the omitted regression:

−2.28=−1.10+(−0.65)(1.81)⏟O.V.Bias=−1.18

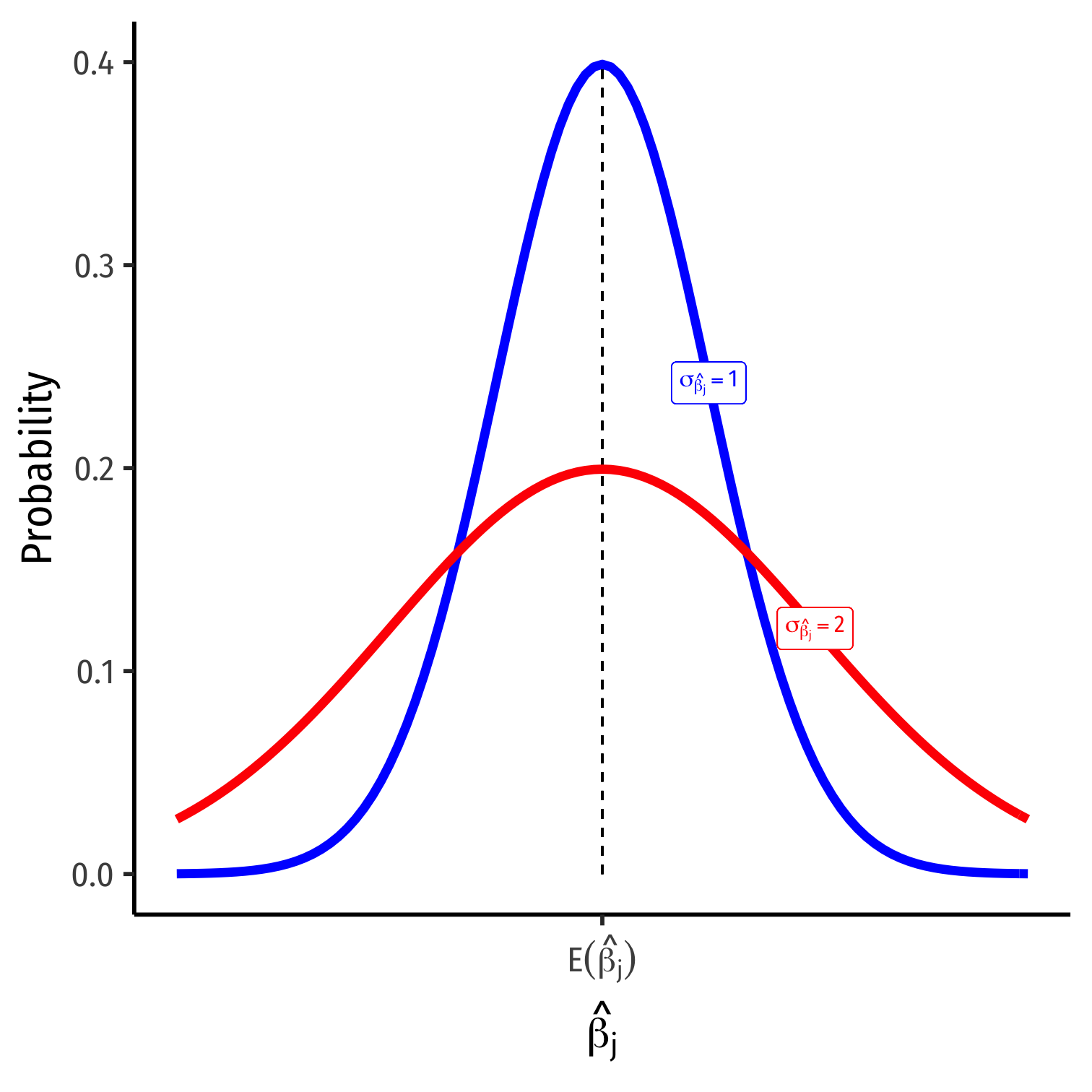

Precision of ^βj

Precision of ^βj I

σ^βj; how precise are our estimates?

Variance σ2^βj or standard error σ^βj

Precision of ^βj II

var(^βj)=11−R2j⏟VIF×(SER)2n×var(X)

se(^βj)=√var(^β1)

- Variation in ^βj is affected by four things now†:

- Goodness of fit of the model (SER)

- Larger SER → larger var(^βj)

- Sample size, n

- Larger n → smaller var(^βj)

- Variance of X

- Larger var(X) → smaller var(^βj)

- Variance Inflation Factor 1(1−R2j)

- Larger VIF, larger var(^βj)

- This is the only new effect

† See Class 2.5 for a reminder of variation with just one X variable.

VIF and Multicollinearity I

- Two independent variables are multicollinear:

cor(Xj,Xl)≠0∀j≠l

VIF and Multicollinearity I

- Two independent variables are multicollinear:

cor(Xj,Xl)≠0∀j≠l

- Multicollinearity between X variables does not bias OLS estimates

- Remember, we pulled another variable out of u into the regression

- If it were omitted, then it would cause omitted variable bias!

VIF and Multicollinearity I

- Two independent variables are multicollinear:

cor(Xj,Xl)≠0∀j≠l

Multicollinearity between X variables does not bias OLS estimates

- Remember, we pulled another variable out of u into the regression

- If it were omitted, then it would cause omitted variable bias!

Multicollinearity does increase the variance of each estimate by

VIF=1(1−R2j)

VIF and Multicollinearity II

VIF=1(1−R2j)

- R2j is the R2 from an auxiliary regression of Xj on all other regressors (X’s)

VIF and Multicollinearity II

VIF=1(1−R2j)

- R2j is the R2 from an auxiliary regression of Xj on all other regressors (X’s)

Example: Suppose we have a regression with three regressors (k=3):

Yi=β0+β1X1i+β2X2i+β3X3i

VIF and Multicollinearity II

VIF=1(1−R2j)

- R2j is the R2 from an auxiliary regression of Xj on all other regressors (X’s)

Example: Suppose we have a regression with three regressors (k=3):

Yi=β0+β1X1i+β2X2i+β3X3i

- There will be three different R2j's, one for each regressor:

R21 for X1i=γ+γX2i+γX3iR22 for X2i=ζ0+ζ1X1i+ζ2X3iR23 for X3i=η0+η1X1i+η2X2i

VIF and Multicollinearity III

VIF=1(1−R2j)

R2j is the R2 from an auxiliary regression of Xj on all other regressors (X's)

The R2j tells us how much other regressors explain regressor Xj

Key Takeaway: If other X variables explain Xj well (high R2J), it will be harder to tell how cleanly Xj→Yi, and so var(^βj) will be higher

VIF and Multicollinearity IV

- Common to calculate the Variance Inflation Factor (VIF) for each regressor:

VIF=1(1−R2j)

- VIF quantifies the factor (scalar) by which var(^βj) increases because of multicollinearity

- e.g. VIF of 2, 3, etc. ⟹ variance increases by 2x, 3x, etc.

VIF and Multicollinearity IV

- Common to calculate the Variance Inflation Factor (VIF) for each regressor:

VIF=1(1−R2j)

- VIF quantifies the factor (scalar) by which var(^βj) increases because of multicollinearity

- e.g. VIF of 2, 3, etc. ⟹ variance increases by 2x, 3x, etc.

- Baseline: R2j=0 ⟹ no multicollinearity ⟹VIF=1 (no inflation)

VIF and Multicollinearity IV

- Common to calculate the Variance Inflation Factor (VIF) for each regressor:

VIF=1(1−R2j)

- VIF quantifies the factor (scalar) by which var(^βj) increases because of multicollinearity

- e.g. VIF of 2, 3, etc. ⟹ variance increases by 2x, 3x, etc.

Baseline: R2j=0 ⟹ no multicollinearity ⟹VIF=1 (no inflation)

Larger R2j ⟹ larger VIF

- Rule of thumb: VIF>10 is problematic

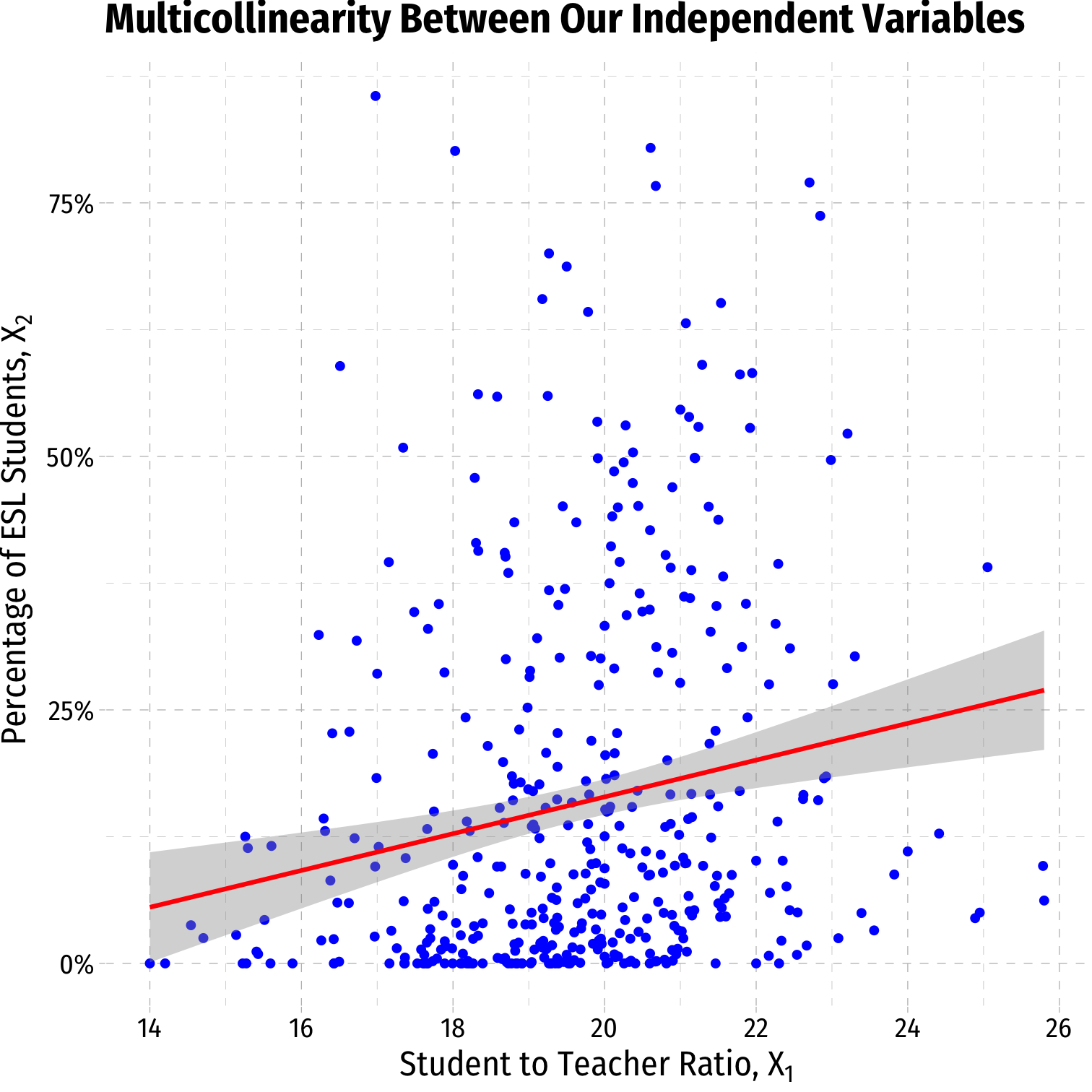

VIF and Multicollinearity V

# scatterplot of X2 on X1ggplot(data=CASchool, aes(x=str,y=el_pct))+ geom_point(color="blue")+ geom_smooth(method="lm", color="red")+ scale_y_continuous(labels=function(x){paste0(x,"%")})+ labs(x = expression(paste("Student to Teacher Ratio, ", X[1])), y = expression(paste("Percentage of ESL Students, ", X[2])), title = "Multicollinearity Between Our Independent Variables")+ ggthemes::theme_pander(base_family = "Fira Sans Condensed", base_size=16)# Make a correlation tableCASchool %>% select(testscr, str, el_pct) %>% cor()## testscr str el_pct## testscr 1.0000000 -0.2263628 -0.6441237## str -0.2263628 1.0000000 0.1876424## el_pct -0.6441237 0.1876424 1.0000000- Cor(STR, %EL) = -0.644

VIF and Multicollinearity in R I

# our multivariate regressionelreg <- lm(testscr ~ str + el_pct, data = CASchool)# use the "car" package for VIF function library("car") # syntax: vif(lm.object)vif(elreg)## str el_pct ## 1.036495 1.036495VIF and Multicollinearity in R I

# our multivariate regressionelreg <- lm(testscr ~ str + el_pct, data = CASchool)# use the "car" package for VIF function library("car") # syntax: vif(lm.object)vif(elreg)## str el_pct ## 1.036495 1.036495- var(^β1) on

strincreases by 1.036 times due to multicollinearity withel_pct - var(^β2) on

el_pctincreases by 1.036 times due to multicollinearity withstr

VIF and Multicollinearity in R II

- Let's calculate VIF manually to see where it comes from:

VIF and Multicollinearity in R II

- Let's calculate VIF manually to see where it comes from:

# run auxiliary regression of x2 on x1auxreg <- lm(el_pct ~ str, data = CASchool)# use broom package's tidy() command (cleaner)library(broom) # load broomtidy(auxreg) # look at reg output| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | -19.854055 | 9.1626044 | -2.166857 | 0.0308099863 |

| str | 1.813719 | 0.4643735 | 3.905733 | 0.0001095165 |

VIF and Multicollinearity in R III

glance(auxreg) # look at aux reg stats for R^2| ABCDEFGHIJ0123456789 |

r.squared <dbl> | adj.r.squared <dbl> | sigma <dbl> | statistic <dbl> | p.value <dbl> | df <dbl> | |

|---|---|---|---|---|---|---|

| 0.03520966 | 0.03290155 | 17.98259 | 15.25475 | 0.0001095165 | 1 |

# extract our R-squared from aux regression (R_j^2)aux_r_sq<-glance(auxreg) %>%

select(r.squared)aux_r_sq # look at it

| ABCDEFGHIJ0123456789 |

r.squared <dbl> | ||||

|---|---|---|---|---|

| 0.03520966 |

VIF and Multicollinearity in R IV

# calculate VIF manuallyour_vif<-1/(1-aux_r_sq) # VIF formula our_vif| ABCDEFGHIJ0123456789 |

r.squared <dbl> | ||||

|---|---|---|---|---|

| 1.036495 |

- Again, multicollinearity between the two X variables inflates the variance on each by 1.036 times

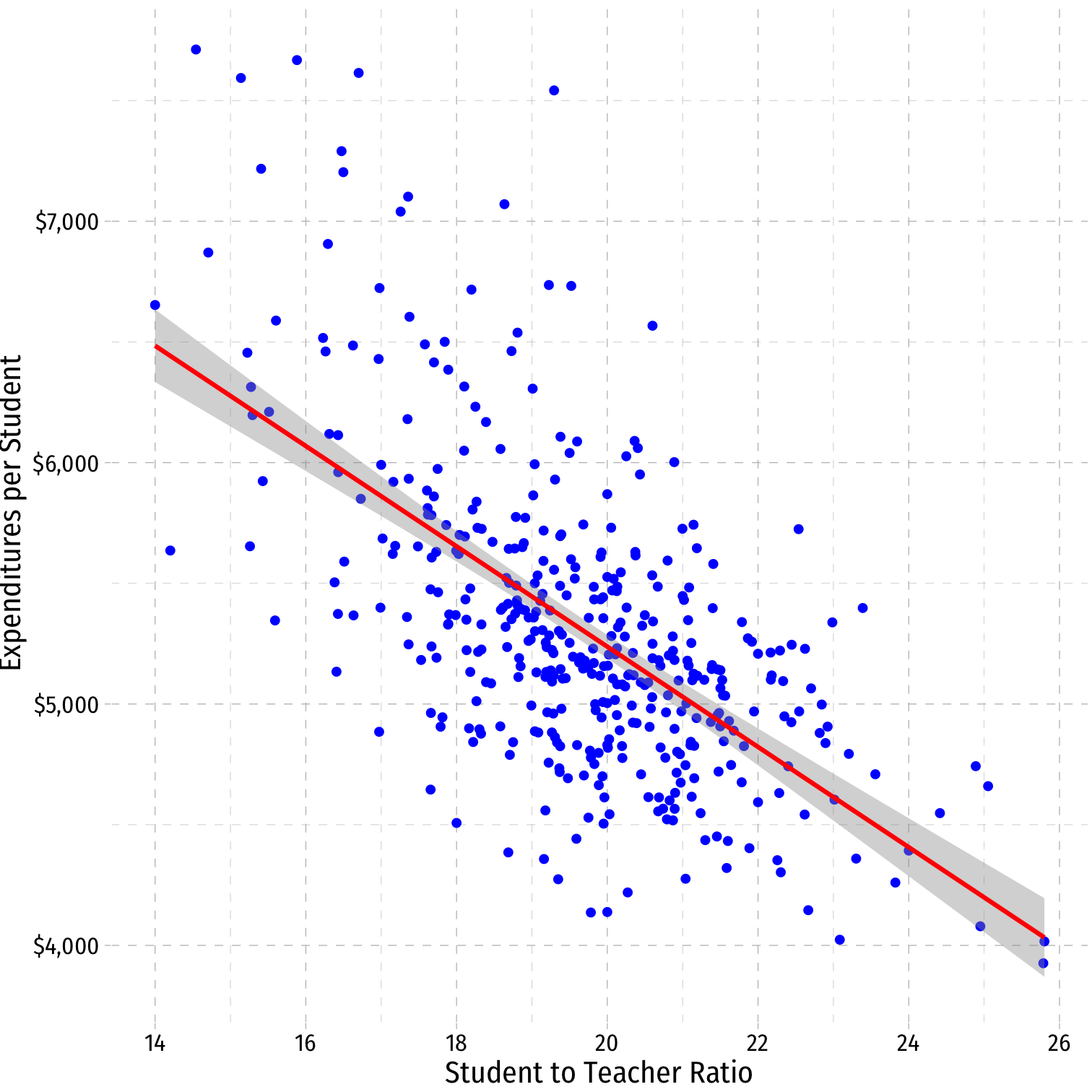

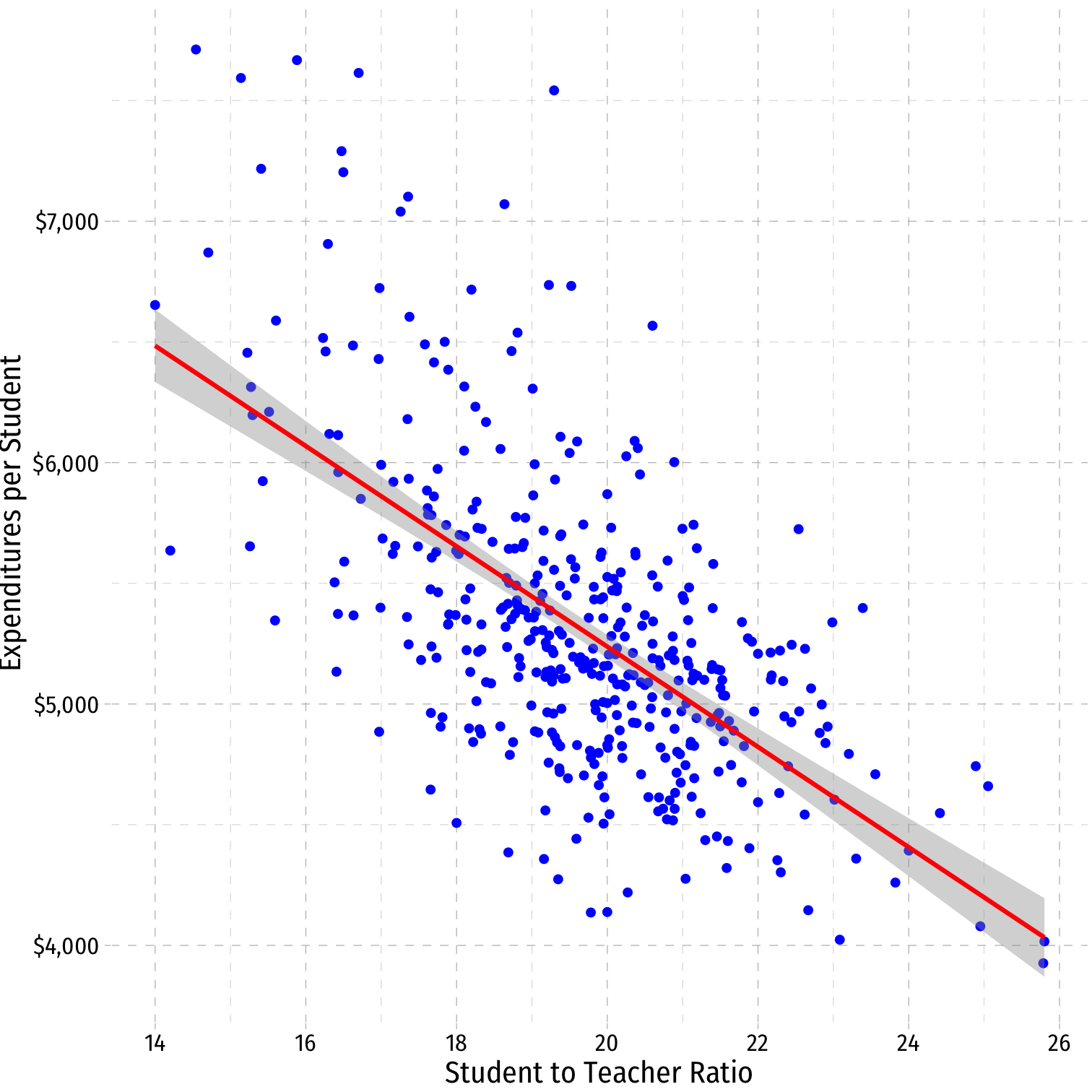

VIF and Multicollinearity: Another Example I

Example: What about district expenditures per student?

CASchool %>% select(testscr, str, expn_stu) %>% cor()## testscr str expn_stu## testscr 1.0000000 -0.2263628 0.1912728## str -0.2263628 1.0000000 -0.6199821## expn_stu 0.1912728 -0.6199821 1.0000000VIF and Multicollinearity: Another Example II

ggplot(data=CASchool, aes(x=str,y=expn_stu))+ geom_point(color="blue")+ geom_smooth(method="lm", color="red")+ scale_y_continuous(labels = scales::dollar)+ labs(x = "Student to Teacher Ratio", y = "Expenditures per Student")+ ggthemes::theme_pander(base_family = "Fira Sans Condensed", base_size=14)

VIF and Multicollinearity: Another Example III

cor(Test score, expn)≠0

cor(STR, expn)≠0

VIF and Multicollinearity: Another Example III

cor(Test score, expn)≠0

cor(STR, expn)≠0

- Omitting expn will bias ^β1 on STR

VIF and Multicollinearity: Another Example III

cor(Test score, expn)≠0

cor(STR, expn)≠0

Omitting expn will bias ^β1 on STR

Including expn will not bias ^β1 on STR, but will make it less precise (higher variance)

VIF and Multicollinearity: Another Example III

- Data tells us little about the effect of a change in STR holding expn constant

- Hard to know what happens to test scores when high STR AND high expn and vice versa (they rarely happen simultaneously)!

VIF and Multicollinearity: Another Example IV

expreg <- lm(testscr ~ str + expn_stu, data = CASchool)expreg %>% tidy()| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | |

|---|---|---|

| (Intercept) | 675.577173851 | |

| str | -1.763215599 | |

| expn_stu | 0.002486571 |

VIF and Multicollinearity: Another Example IV

expreg <- lm(testscr ~ str + expn_stu, data = CASchool)expreg %>% tidy()| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | |

|---|---|---|

| (Intercept) | 675.577173851 | |

| str | -1.763215599 | |

| expn_stu | 0.002486571 |

expreg %>% vif()## str expn_stu ## 1.624373 1.624373- Including

expn_stuincreases variance of ^β1 and ^β2 by 1.62x (62%)

Multicollinearity Increases Variance

library(huxtable)huxreg("Model 1" = school_reg, "Model 2" = expreg, coefs = c("Intercept" = "(Intercept)", "Class Size" = "str", "Expenditures per Student" = "expn_stu"), statistics = c("N" = "nobs", "R-Squared" = "r.squared", "SER" = "sigma"), number_format = 2)- We can see SE(^β1) on

strincreases from 0.48 to 0.61 when we addexpn_stu

| Model 1 | Model 2 | |

|---|---|---|

| Intercept | 698.93 *** | 675.58 *** |

| (9.47) | (19.56) | |

| Class Size | -2.28 *** | -1.76 ** |

| (0.48) | (0.61) | |

| Expenditures per Student | 0.00 | |

| (0.00) | ||

| N | 420 | 420 |

| R-Squared | 0.05 | 0.06 |

| SER | 18.58 | 18.56 |

| *** p < 0.001; ** p < 0.01; * p < 0.05. | ||

Perfect Multicollinearity

- Perfect multicollinearity is when a regressor is an exact linear function of (an)other regressor(s)

Perfect Multicollinearity

- Perfect multicollinearity is when a regressor is an exact linear function of (an)other regressor(s)

^Sales=^β0+^β1Temperature (C)+^β2Temperature (F)

Perfect Multicollinearity

- Perfect multicollinearity is when a regressor is an exact linear function of (an)other regressor(s)

^Sales=^β0+^β1Temperature (C)+^β2Temperature (F)

Temperature (F)=32+1.8∗Temperature (C)

Perfect Multicollinearity

- Perfect multicollinearity is when a regressor is an exact linear function of (an)other regressor(s)

^Sales=^β0+^β1Temperature (C)+^β2Temperature (F)

Temperature (F)=32+1.8∗Temperature (C)

- cor(temperature (F), temperature (C))=1

Perfect Multicollinearity

- Perfect multicollinearity is when a regressor is an exact linear function of (an)other regressor(s)

^Sales=^β0+^β1Temperature (C)+^β2Temperature (F)

Temperature (F)=32+1.8∗Temperature (C)

cor(temperature (F), temperature (C))=1

R2j=1 is implying VIF=11−1 and var(^βj)=0!

Perfect Multicollinearity

- Perfect multicollinearity is when a regressor is an exact linear function of (an)other regressor(s)

^Sales=^β0+^β1Temperature (C)+^β2Temperature (F)

Temperature (F)=32+1.8∗Temperature (C)

cor(temperature (F), temperature (C))=1

R2j=1 is implying VIF=11−1 and var(^βj)=0!

This is fatal for a regression

- A logical impossiblity, always caused by human error

Perfect Multicollinearity: Example

Example:

^TestScorei=^β0+^β1STRi+^β2%EL+^β3%EF

%EL: the percentage of students learning English

%EF: the percentage of students fluent in English

EF=100−EL

|cor(EF,EL)|=1

Perfect Multicollinearity Example II

# generate %EF variable from %ELCASchool_ex <- CASchool %>% mutate(ef_pct = 100 - el_pct)# get correlation between %EL and %EFCASchool_ex %>% summarize(cor = cor(ef_pct, el_pct))| cor |

|---|

| -1 |

Perfect Multicollinearity Example III

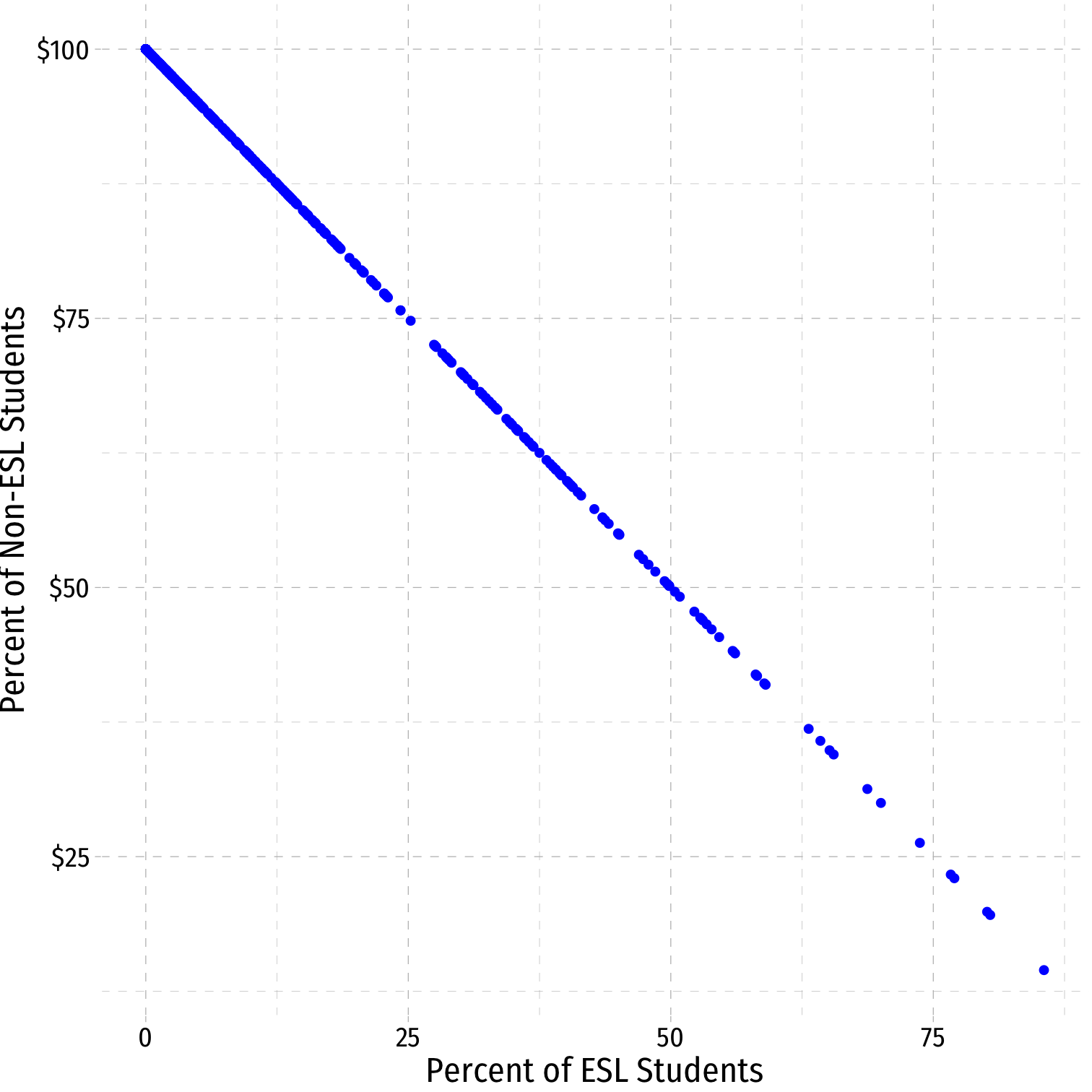

ggplot(data=CASchool_ex, aes(x=el_pct,y=ef_pct))+ geom_point(color="blue")+ scale_y_continuous(labels = scales::dollar)+ labs(x = "Percent of ESL Students", y = "Percent of Non-ESL Students")+ ggthemes::theme_pander(base_family = "Fira Sans Condensed", base_size=16)

Perfect Multicollinearity Example IV

mcreg <- lm(testscr ~ str + el_pct + ef_pct, data = CASchool_ex)summary(mcreg)## ## Call:## lm(formula = testscr ~ str + el_pct + ef_pct, data = CASchool_ex)## ## Residuals:## Min 1Q Median 3Q Max ## -48.845 -10.240 -0.308 9.815 43.461 ## ## Coefficients: (1 not defined because of singularities)## Estimate Std. Error t value Pr(>|t|) ## (Intercept) 686.03225 7.41131 92.566 < 2e-16 ***## str -1.10130 0.38028 -2.896 0.00398 ** ## el_pct -0.64978 0.03934 -16.516 < 2e-16 ***## ef_pct NA NA NA NA ## ---## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1## ## Residual standard error: 14.46 on 417 degrees of freedom## Multiple R-squared: 0.4264, Adjusted R-squared: 0.4237 ## F-statistic: 155 on 2 and 417 DF, p-value: < 2.2e-16mcreg %>% tidy()| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 686 | 7.41 | 92.6 | 3.87e-280 |

| str | -1.1 | 0.38 | -2.9 | 0.00398 |

| el_pct | -0.65 | 0.0393 | -16.5 | 1.66e-47 |

| ef_pct |

- Note

Rdrops one of the multicollinear regressors (ef_pct) if you include both 🤡

A Summary of Multivariate OLS Estimator Properties

A Summary of Multivariate OLS Estimator Properties

^βj on Xj is biased only if there is an omitted variable (Z) such that:

- cor(Y,Z)≠0

- cor(Xj,Z)≠0

- If Z is included and Xj is collinear with Z, this does not cause a bias

var[^βj] and se[^βj] measure precision (or uncertainty) of estimate:

A Summary of Multivariate OLS Estimator Properties

^βj on Xj is biased only if there is an omitted variable (Z) such that:

- cor(Y,Z)≠0

- cor(Xj,Z)≠0

- If Z is included and Xj is collinear with Z, this does not cause a bias

var[^βj] and se[^βj] measure precision (or uncertainty) of estimate:

var[^βj]=1(1−R2j)∗SER2n×var[Xj]

- VIF from multicollinearity: 1(1−R2j)

- R2j for auxiliary regression of Xj on all other X's

- mutlicollinearity does not bias ^βj but raises its variance

- perfect multicollinearity if X's are linear function of others

Updated Measures of Fit

(Updated) Measures of Fit

Again, how well does a linear model fit the data?

How much variation in Yi is “explained” by variation in the model (^Yi)?

(Updated) Measures of Fit

Again, how well does a linear model fit the data?

How much variation in Yi is “explained” by variation in the model (^Yi)?

Yi=^Yi+^ui^ui=Yi−^Yi

(Updated) Measures of Fit: SER

- Again, the Standard errror of the regression (SER) estimates the standard error of u

SER=SSEn−k−1

A measure of the spread of the observations around the regression line (in units of Y), the average "size" of the residual

Only new change: divided by n−k−1 due to use of k+1 degrees of freedom to first estimate β0 and then all of the other β's for the k number of regressors†

† Again, because your textbook defines k as including the constant, the denominator would be n-k instead of n-k-1.

(Updated) Measures of Fit: R2

R2=ESSTSS=1−SSETSS=(rX,Y)2

- Again, R2 is fraction of variation of the model (^Yi (“explained sum of squares”) to the variation of observations of Yi (“total sum of squares”)

(Updated) Measures of Fit: Adjusted ˉR2

Problem: R2 of a regression increases every time a new variable is added (it reduces SSE!)

This does not mean adding a variable improves the fit of the model per se, R2 gets inflated

(Updated) Measures of Fit: Adjusted ˉR2

Problem: R2 of a regression increases every time a new variable is added (it reduces SSE!)

This does not mean adding a variable improves the fit of the model per se, R2 gets inflated

We correct for this effect with the adjusted R2:

ˉR2=1−n−1n−k−1×SSETSS

- There are different methods to compute ˉR2, and in the end, recall R2 was never very useful, so don't worry about knowing the formula

- Large sample sizes (n) make R2 and ˉR2 very close

In R (base)

## ## Call:## lm(formula = testscr ~ str + el_pct, data = CASchool)## ## Residuals:## Min 1Q Median 3Q Max ## -48.845 -10.240 -0.308 9.815 43.461 ## ## Coefficients:## Estimate Std. Error t value Pr(>|t|) ## (Intercept) 686.03225 7.41131 92.566 < 2e-16 ***## str -1.10130 0.38028 -2.896 0.00398 ** ## el_pct -0.64978 0.03934 -16.516 < 2e-16 ***## ---## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1## ## Residual standard error: 14.46 on 417 degrees of freedom## Multiple R-squared: 0.4264, Adjusted R-squared: 0.4237 ## F-statistic: 155 on 2 and 417 DF, p-value: < 2.2e-16- Base R2 (

Rcalls it “Multiple R-squared”) went up Adjusted R-squaredwent down

In R (broom)

elreg %>% glance()| r.squared | adj.r.squared | sigma | statistic | p.value | df | logLik | AIC | BIC | deviance | df.residual | nobs |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.426 | 0.424 | 14.5 | 155 | 4.62e-51 | 2 | -1.72e+03 | 3.44e+03 | 3.46e+03 | 8.72e+04 | 417 | 420 |