3.8 — Polynomial Regression

ECON 480 • Econometrics • Fall 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/metricsF20

metricsF20.classes.ryansafner.com

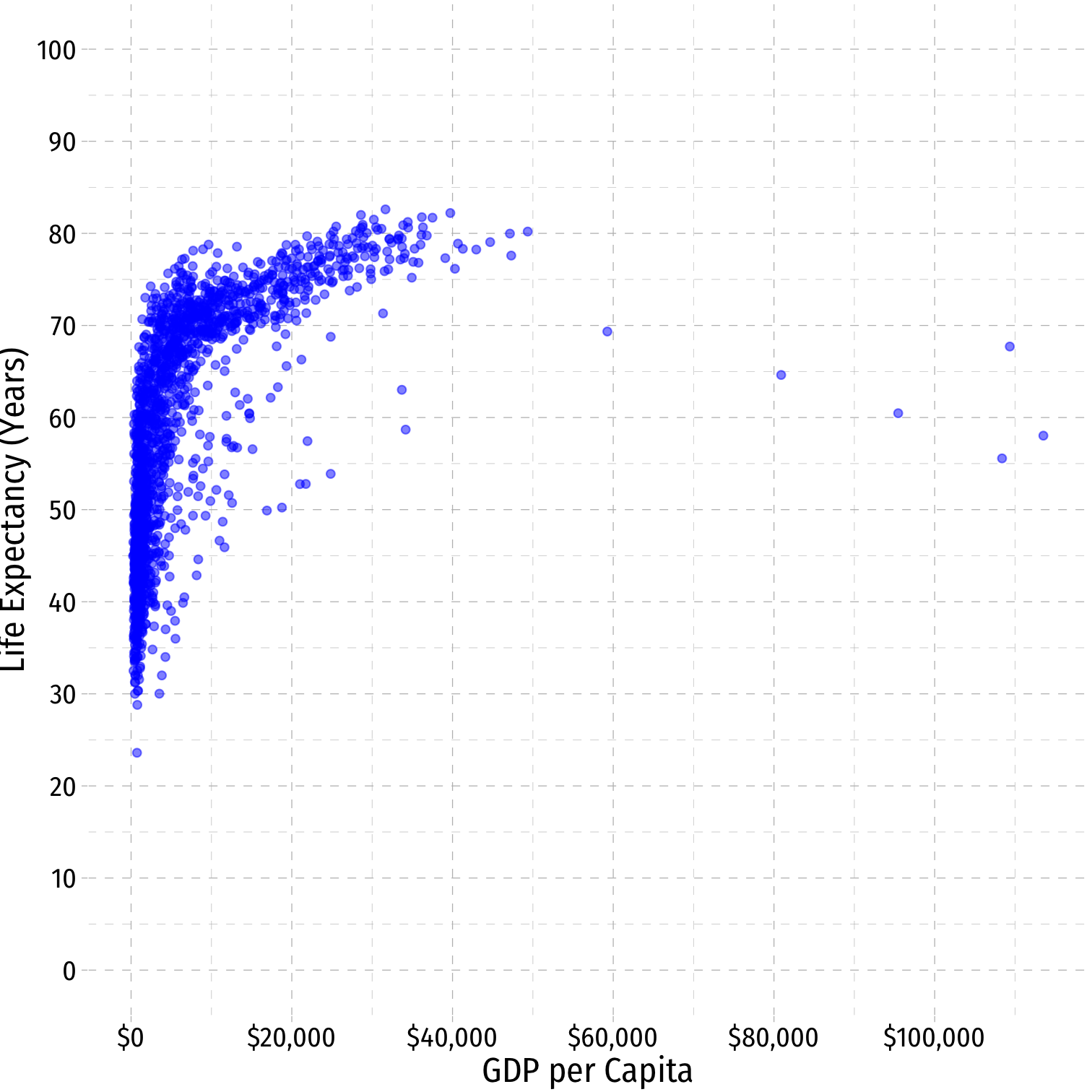

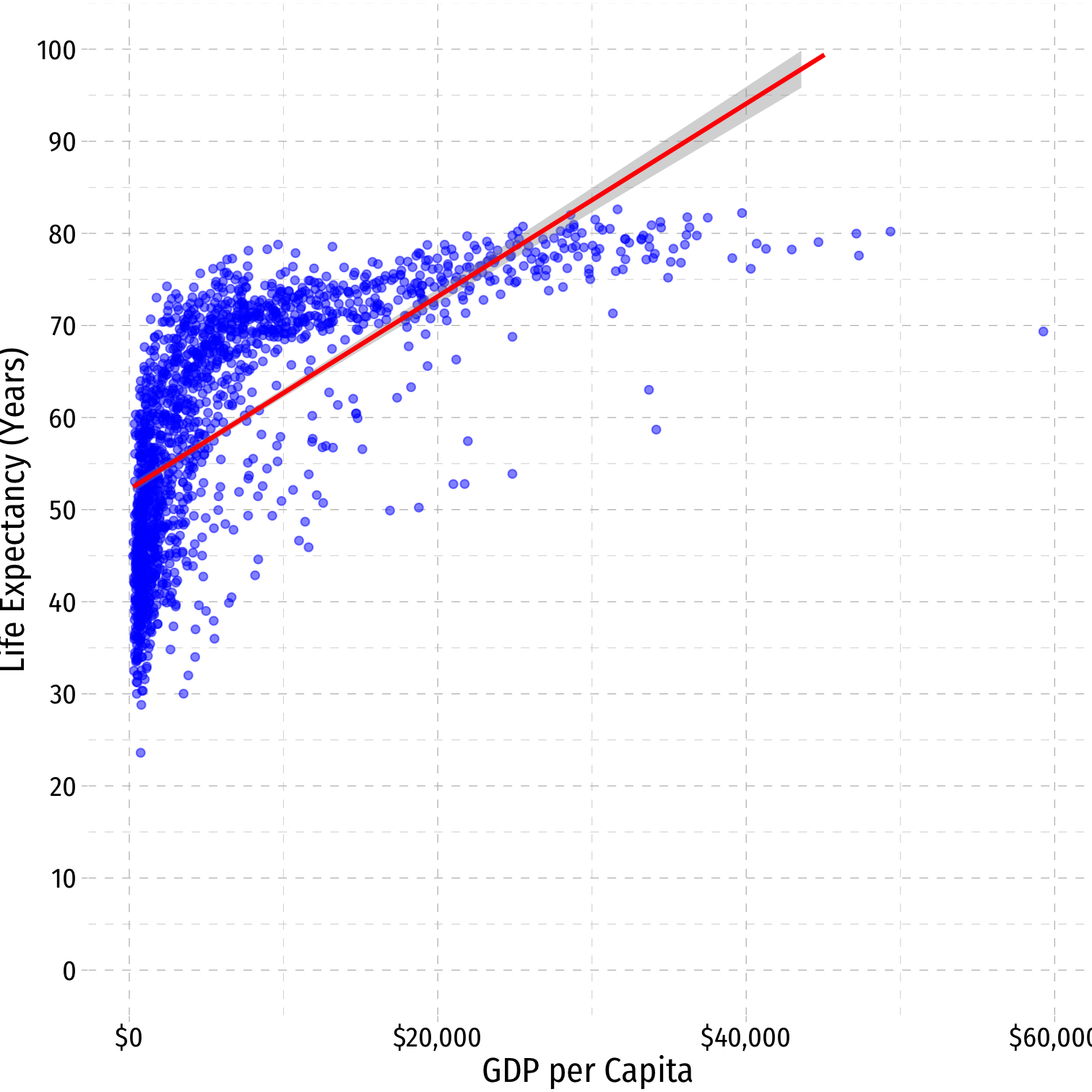

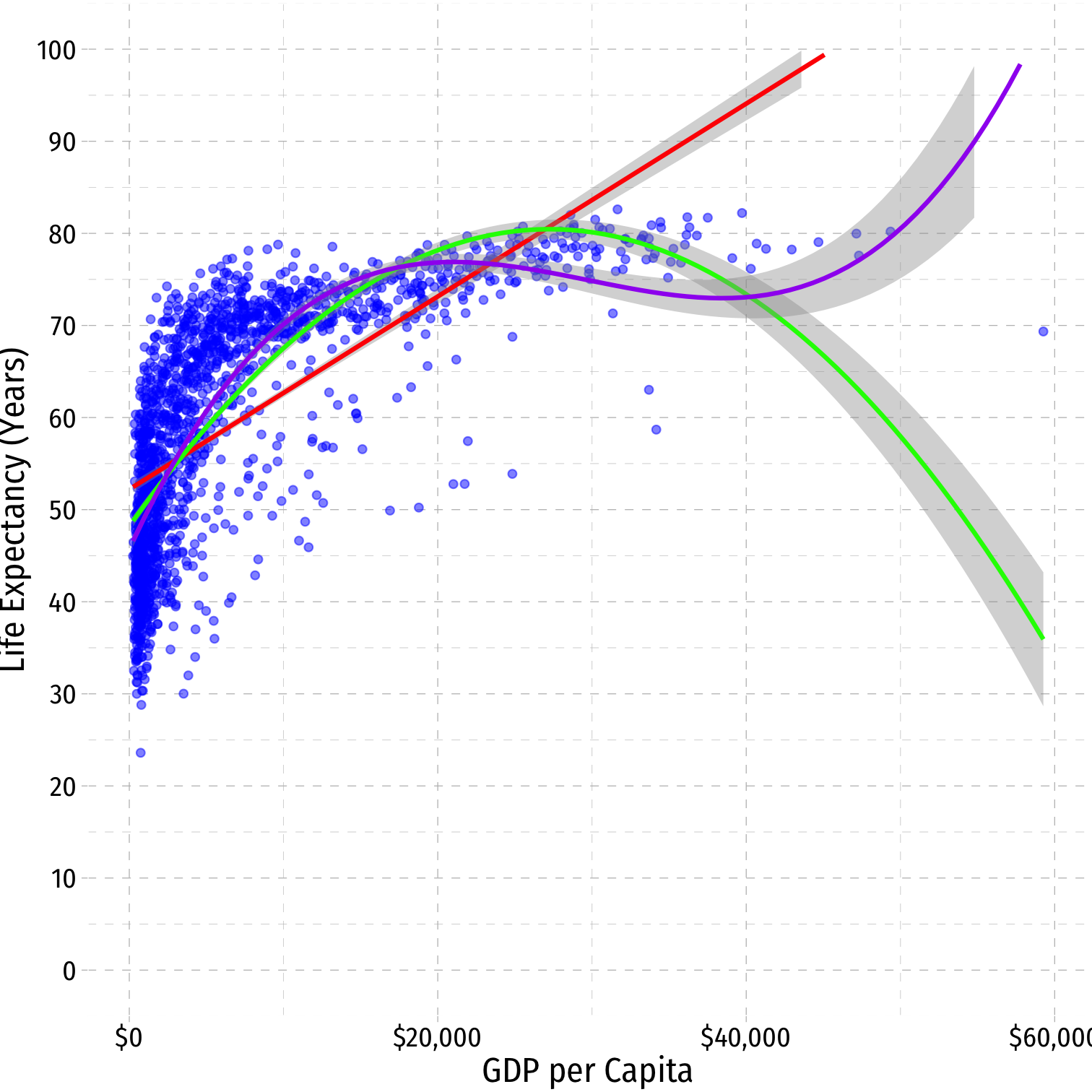

Linear Regression

OLS is commonly known as "linear regression" as it fits a straight line to data points

Often, data and relationships between variables may not be linear

Linear Regression

OLS is commonly known as "linear regression" as it fits a straight line to data points

Often, data and relationships between variables may not be linear

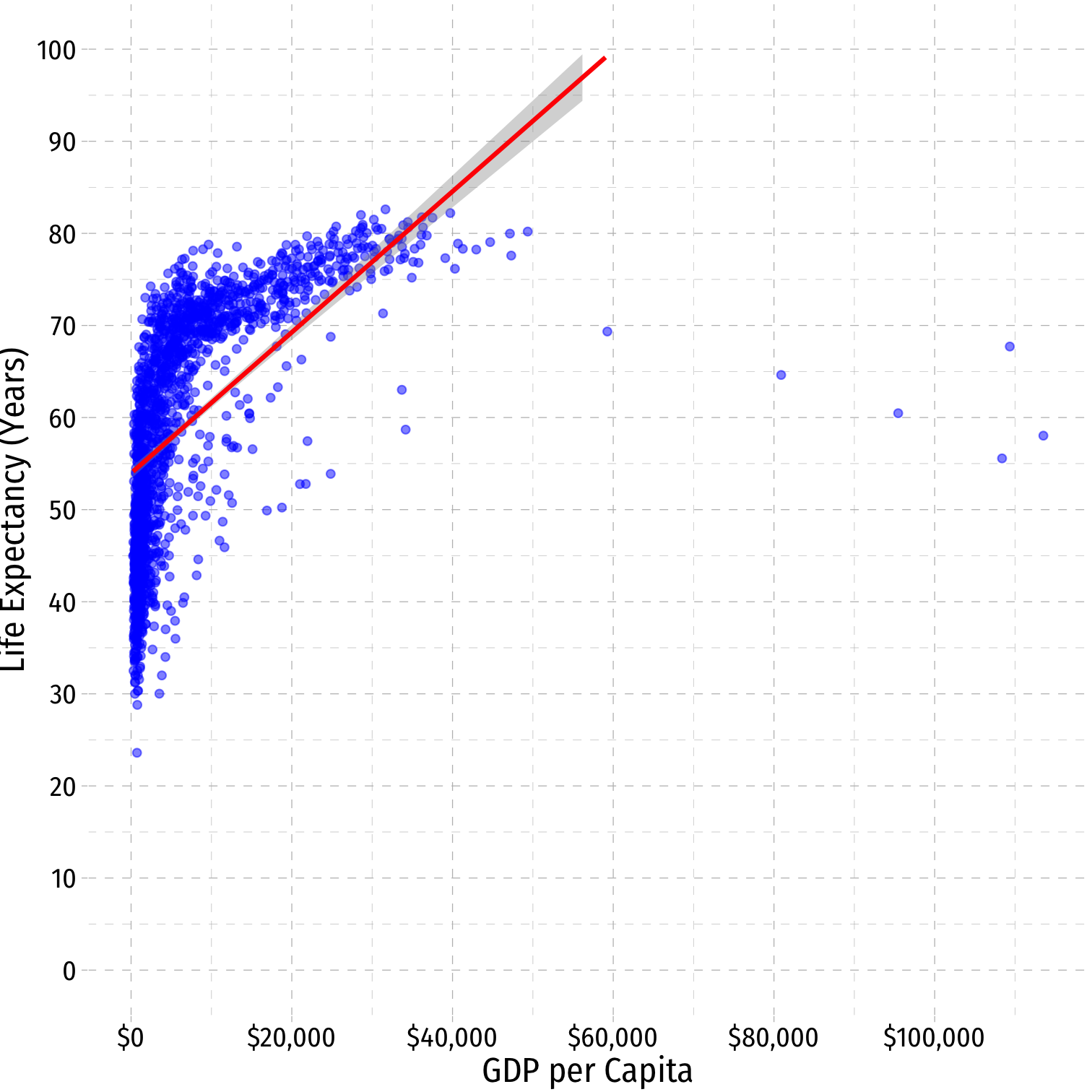

Linear Regression

OLS is commonly known as "linear regression" as it fits a straight line to data points

Often, data and relationships between variables may not be linear

^Life Expectancyi=^β0+^β1GDP per capitai

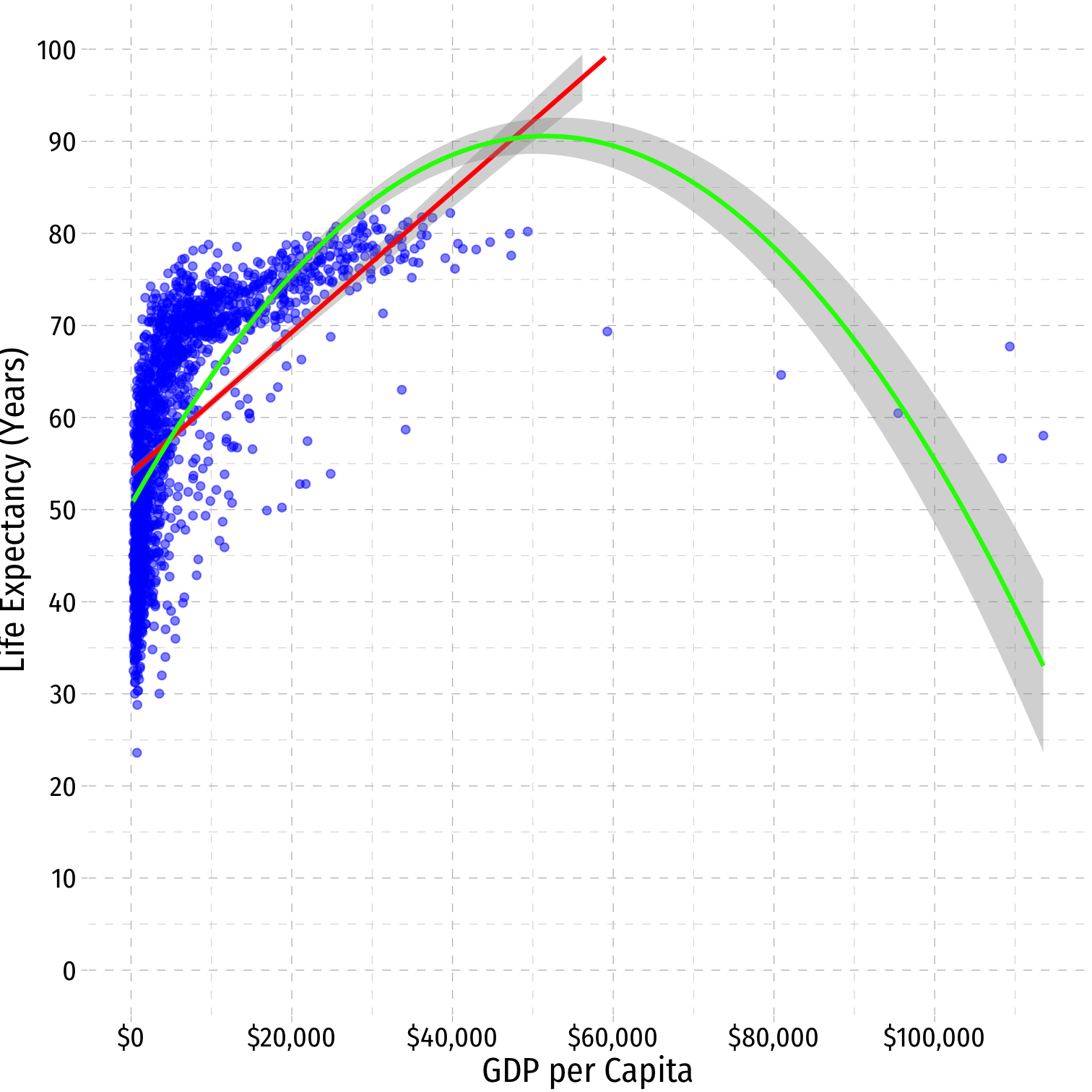

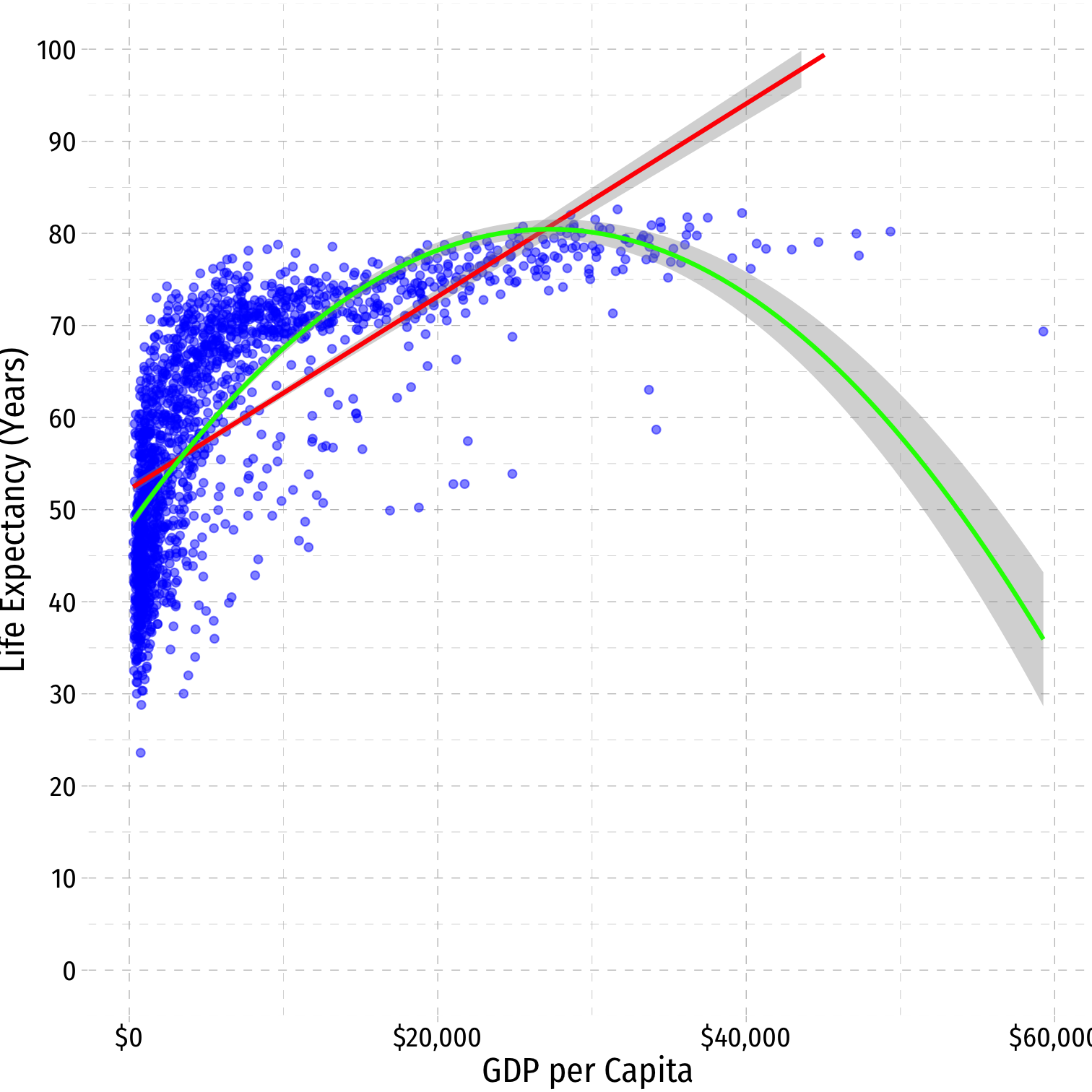

Linear Regression

OLS is commonly known as "linear regression" as it fits a straight line to data points

Often, data and relationships between variables may not be linear

^Life Expectancyi=^β0+^β1GDP per capitai

^Life Expectancyi=^β0+^β1GDP per capitai+^β2GDP per capita2i

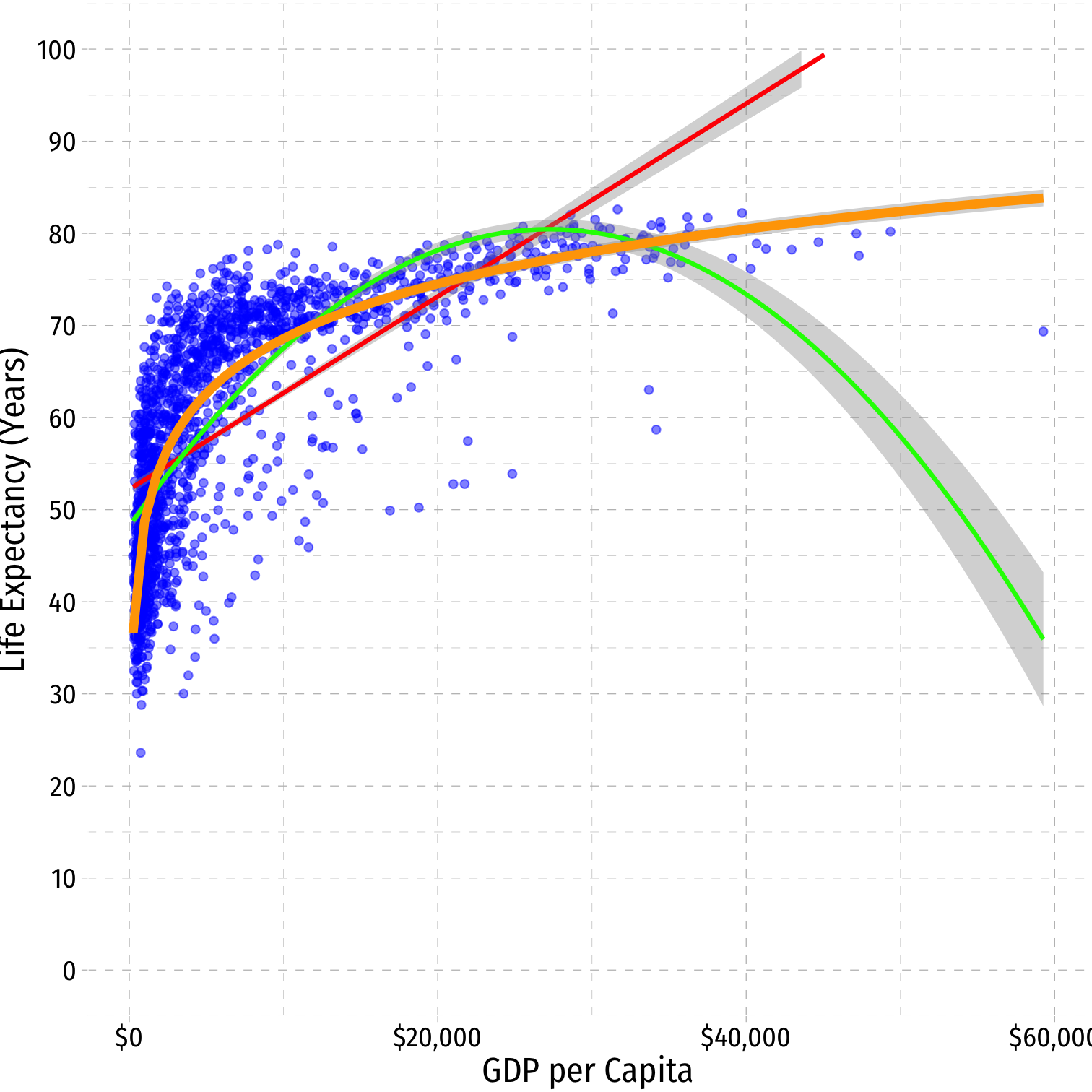

Linear Regression

OLS is commonly known as "linear regression" as it fits a straight line to data points

Often, data and relationships between variables may not be linear

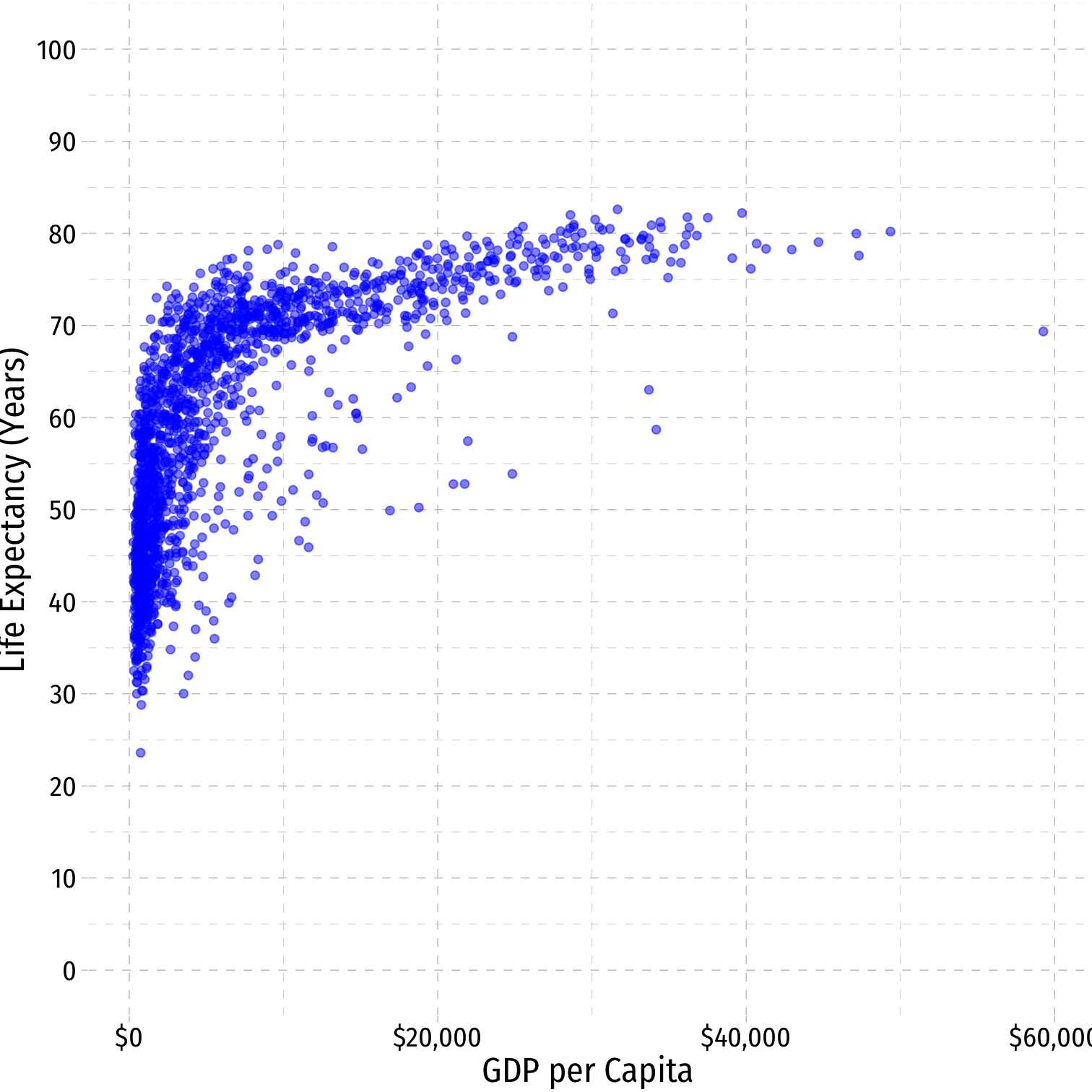

Get rid of the outliers (>$60,000)

Linear Regression

OLS is commonly known as "linear regression" as it fits a straight line to data points

Often, data and relationships between variables may not be linear

Get rid of the outliers (>$60,000)

^Life Expectancyi=^β0+^β1GDP per capitai

Linear Regression

OLS is commonly known as "linear regression" as it fits a straight line to data points

Often, data and relationships between variables may not be linear

Get rid of the outliers (>$60,000)

^Life Expectancyi=^β0+^β1GDP per capitai

^Life Expectancyi=^β0+^β1GDP per capitai+^β2GDP per capita2i

Linear Regression

OLS is commonly known as "linear regression" as it fits a straight line to data points

Often, data and relationships between variables may not be linear

Get rid of the outliers (>$60,000)

^Life Expectancyi=^β0+^β1GDP per capitai

^Life Expectancyi=^β0+^β1GDP per capitai+^β2GDP per capita2i

^Life Expectancyi=^β0+^β1ln(GDP per capitai)

Nonlinear Effects in Linear Regression

Despite being "linear regression", OLS can handle this with an easy fix

OLS requires all parameters (i.e. the β's) to be linear, the regressors (X's) can be nonlinear:

Nonlinear Effects in Linear Regression

Despite being "linear regression", OLS can handle this with an easy fix

OLS requires all parameters (i.e. the β's) to be linear, the regressors (X's) can be nonlinear:

Yi=β0+β1X2i✅

Nonlinear Effects in Linear Regression

Despite being "linear regression", OLS can handle this with an easy fix

OLS requires all parameters (i.e. the β's) to be linear, the regressors (X's) can be nonlinear:

Yi=β0+β1X2i✅

Yi=β0+β21Xi❌

Nonlinear Effects in Linear Regression

Despite being "linear regression", OLS can handle this with an easy fix

OLS requires all parameters (i.e. the β's) to be linear, the regressors (X's) can be nonlinear:

Yi=β0+β1X2i✅

Yi=β0+β21Xi❌

Yi=β0+β1√Xi✅

Nonlinear Effects in Linear Regression

Despite being "linear regression", OLS can handle this with an easy fix

OLS requires all parameters (i.e. the β's) to be linear, the regressors (X's) can be nonlinear:

Yi=β0+β1X2i✅

Yi=β0+β21Xi❌

Yi=β0+β1√Xi✅

Yi=β0+√β1Xi❌

Nonlinear Effects in Linear Regression

Despite being "linear regression", OLS can handle this with an easy fix

OLS requires all parameters (i.e. the β's) to be linear, the regressors (X's) can be nonlinear:

Yi=β0+β1X2i✅

Yi=β0+β21Xi❌

Yi=β0+β1√Xi✅

Yi=β0+√β1Xi❌

Yi=β0+β1(X1i×X2i)✅

Nonlinear Effects in Linear Regression

Despite being "linear regression", OLS can handle this with an easy fix

OLS requires all parameters (i.e. the β's) to be linear, the regressors (X's) can be nonlinear:

Yi=β0+β1X2i✅

Yi=β0+β21Xi❌

Yi=β0+β1√Xi✅

Yi=β0+√β1Xi❌

Yi=β0+β1(X1i×X2i)✅

Yi=β0+β1ln(Xi)✅

Nonlinear Effects in Linear Regression

Despite being "linear regression", OLS can handle this with an easy fix

OLS requires all parameters (i.e. the β's) to be linear, the regressors (X's) can be nonlinear:

Yi=β0+β1X2i✅

Yi=β0+β21Xi❌

Yi=β0+β1√Xi✅

Yi=β0+√β1Xi❌

Yi=β0+β1(X1i×X2i)✅

Yi=β0+β1ln(Xi)✅

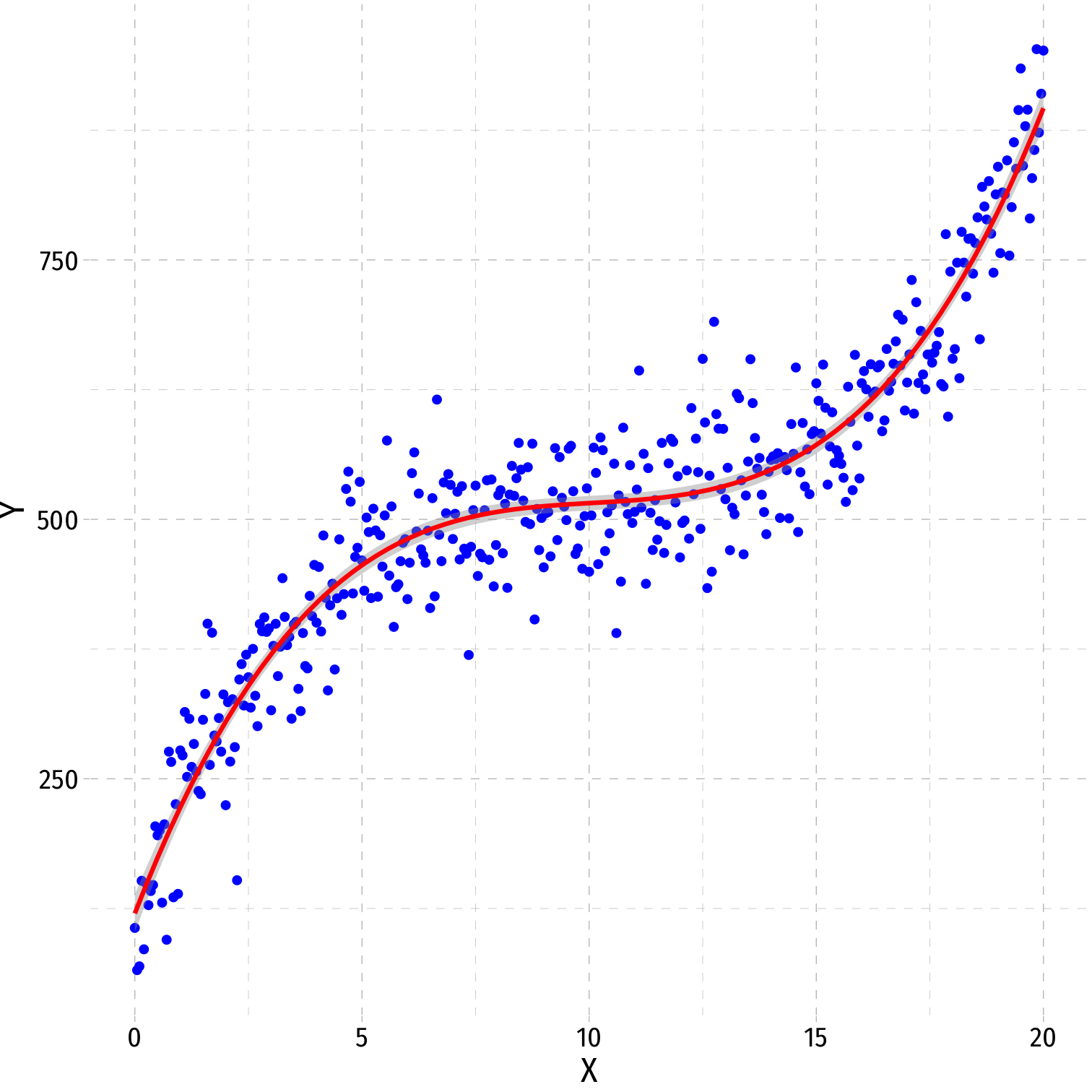

In the end, each X is always just a number in the data, OLS can always estimate parameters for it

Plotting the modelled points (Xi,^Yi) can result in a curve!

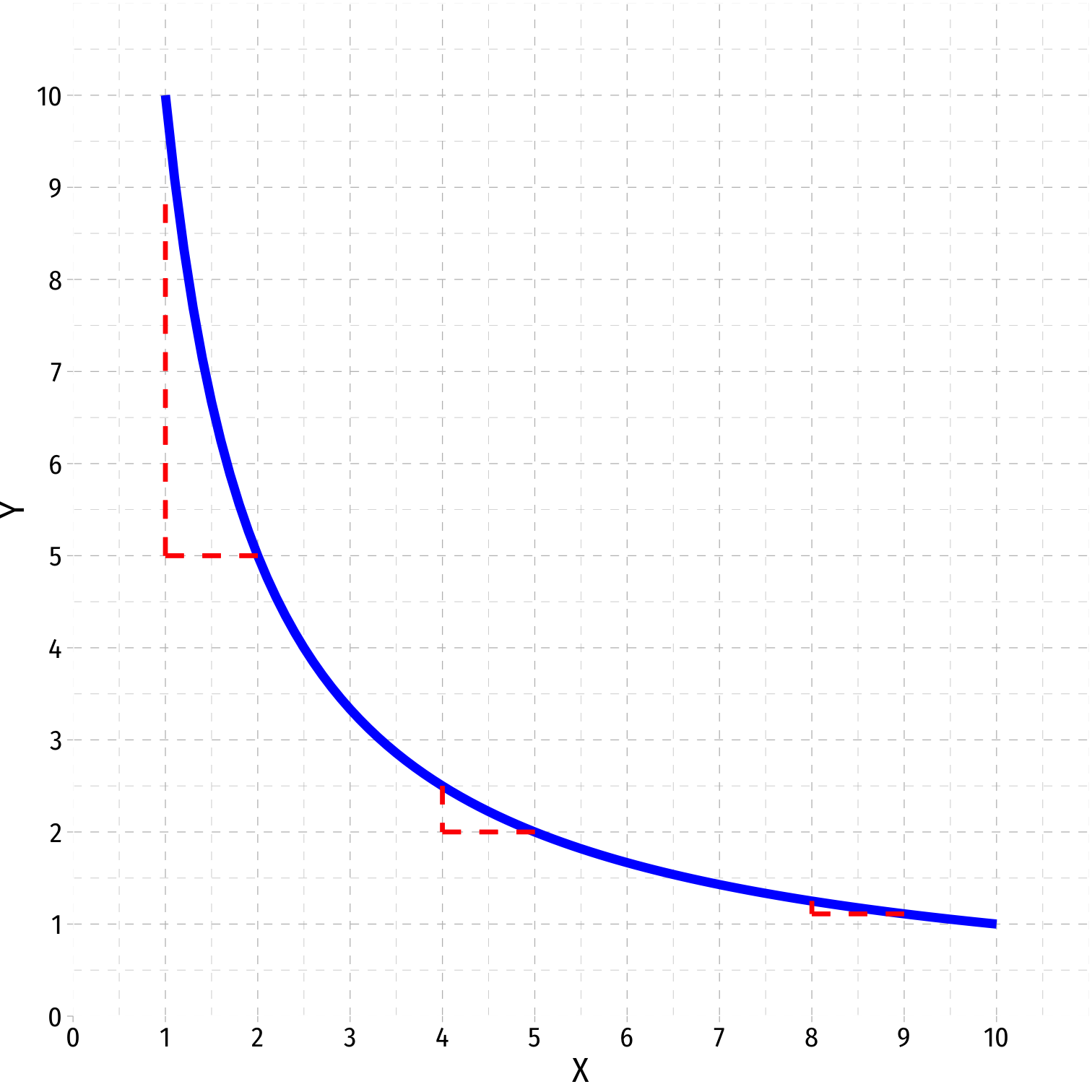

Sources of Nonlinearities

- Effect of X1→Y might be nonlinear if:

Sources of Nonlinearities

- Effect of X1→Y might be nonlinear if:

- X1→Y is different for different levels of X1

- e.g. diminishing returns: ↑X1 increases Y at a decreasing rate

- e.g. increasing returns: ↑X1 increases Y at an increasing rate

Sources of Nonlinearities

- Effect of X1→Y might be nonlinear if:

X1→Y is different for different levels of X1

- e.g. diminishing returns: ↑X1 increases Y at a decreasing rate

- e.g. increasing returns: ↑X1 increases Y at an increasing rate

X1→Y is different for different levels of X2

- e.g. interaction effects (last lesson)

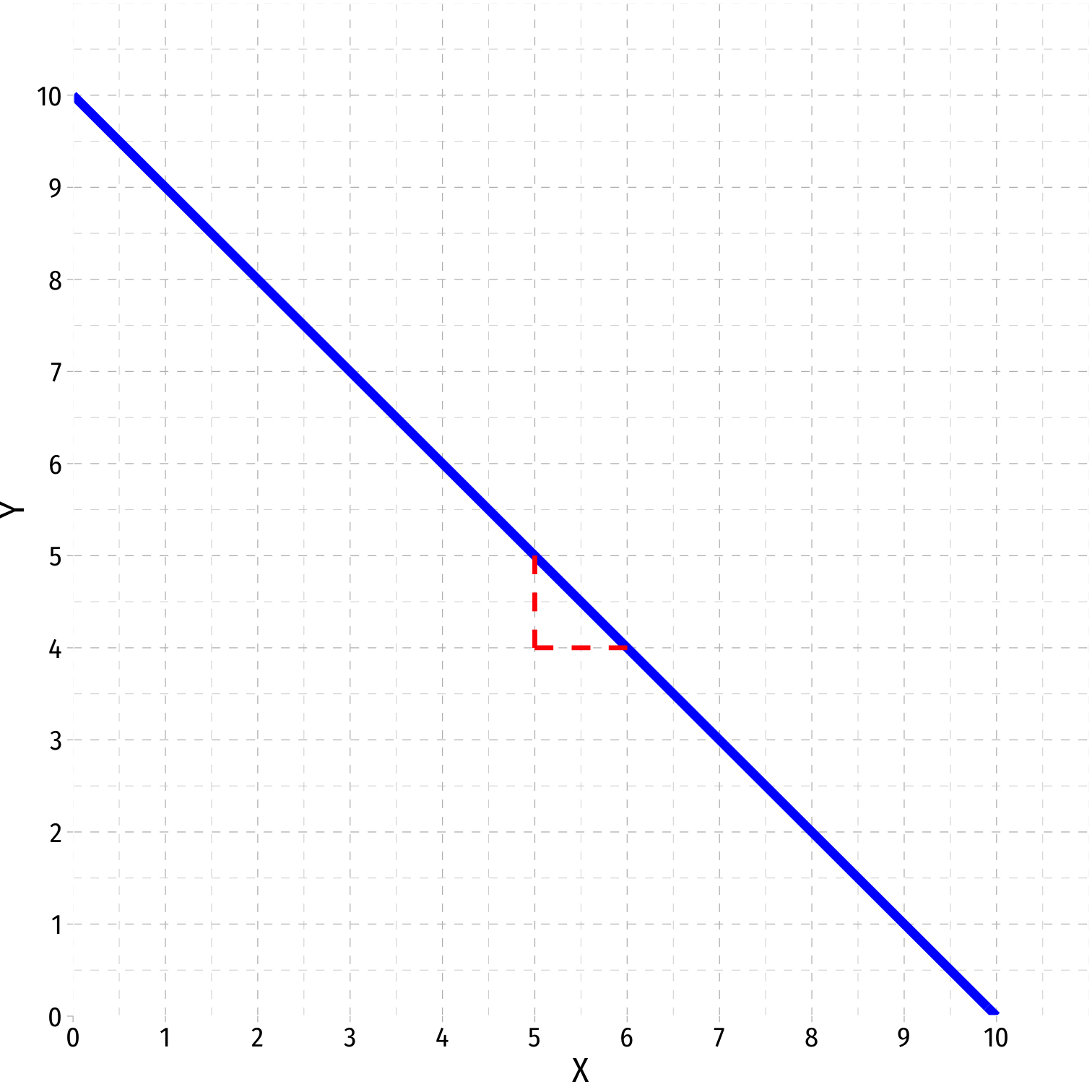

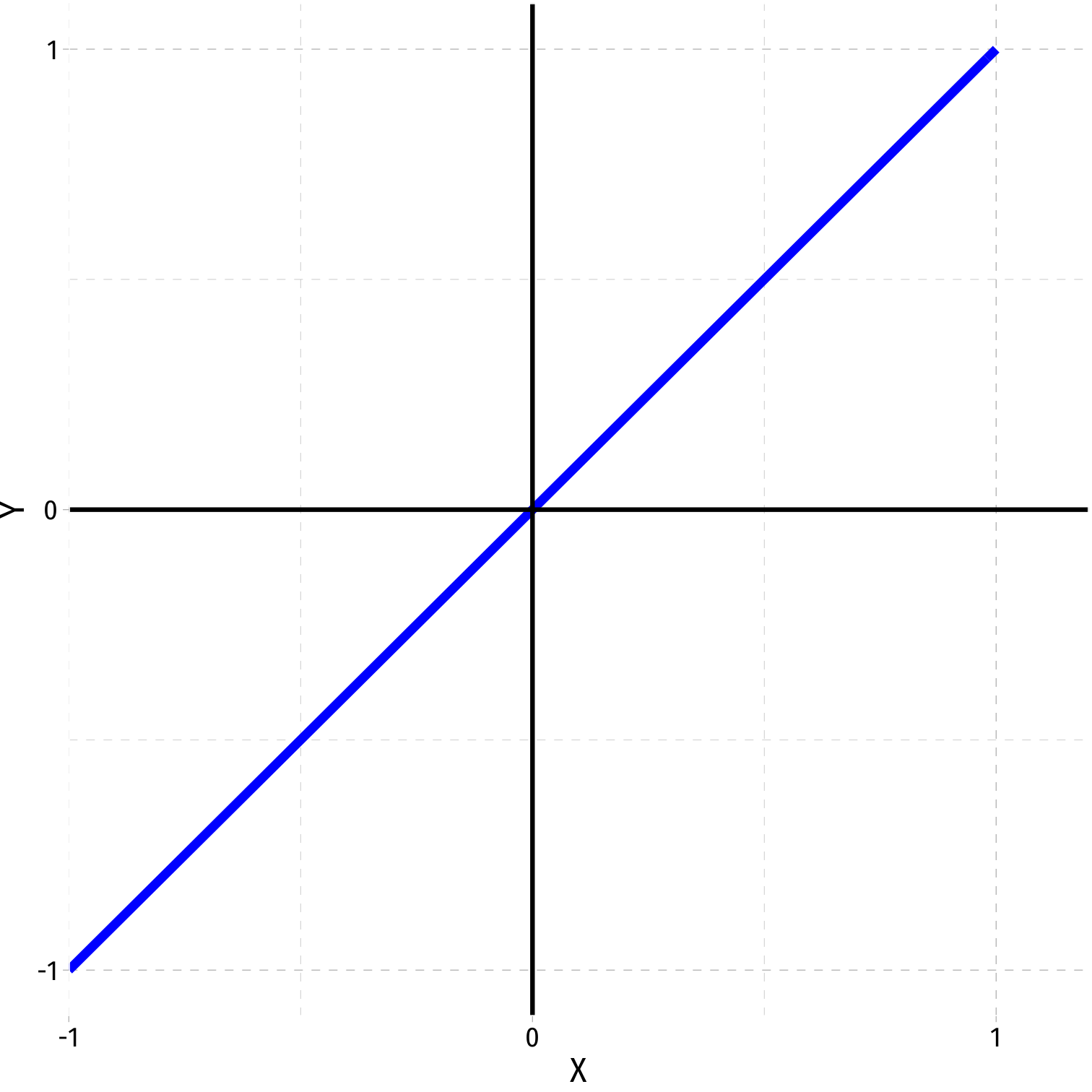

Nonlinearities Alter Marginal Effects

Linear: Y=^β0+^β1X

marginal effect (slope), (^β1)=ΔYΔX is constant for all X

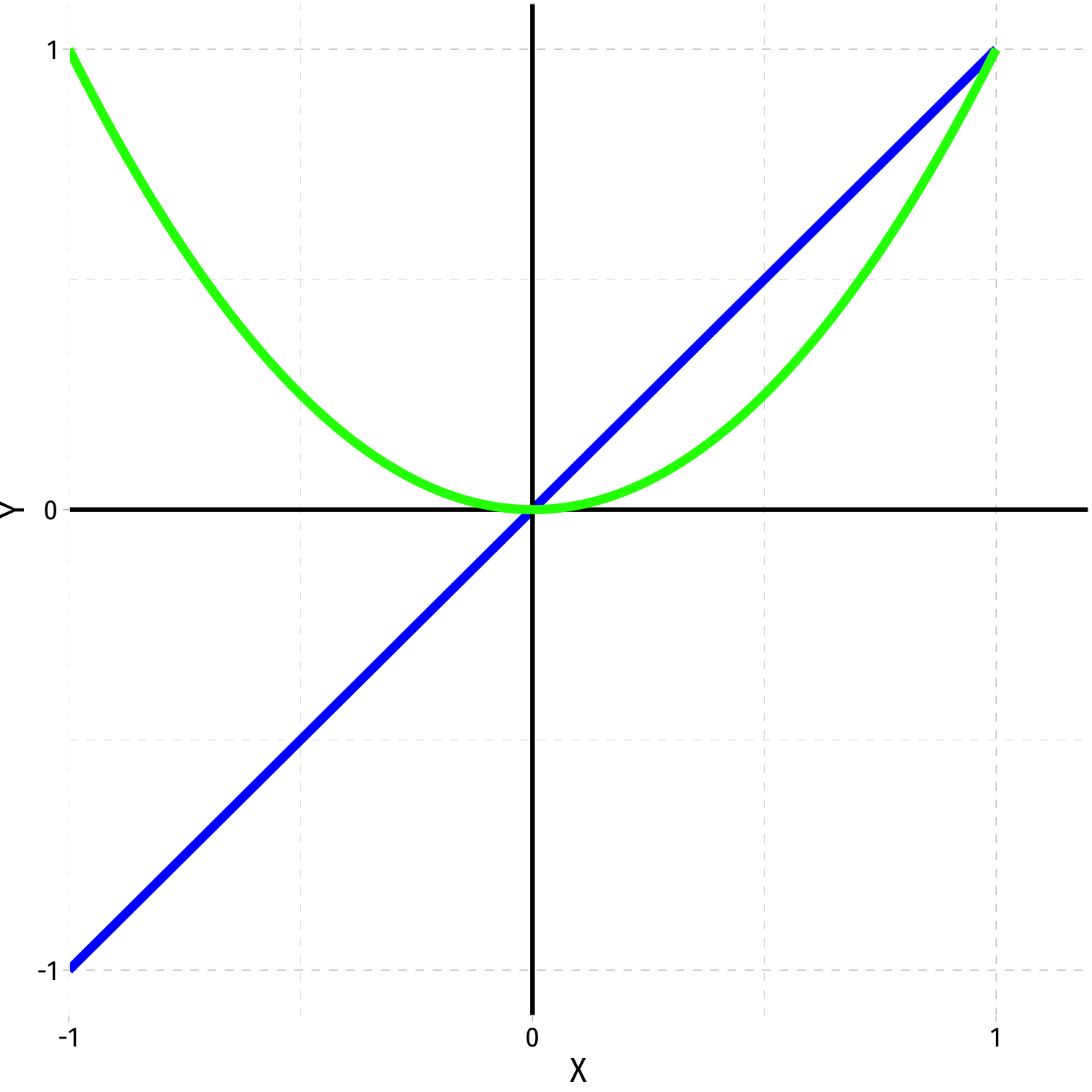

Nonlinearities Alter Marginal Effects

Polynomial: Y=^β0+^β1X+^β2X2

Marginal effect, “slope” (≠^β1) depends on the value of X!

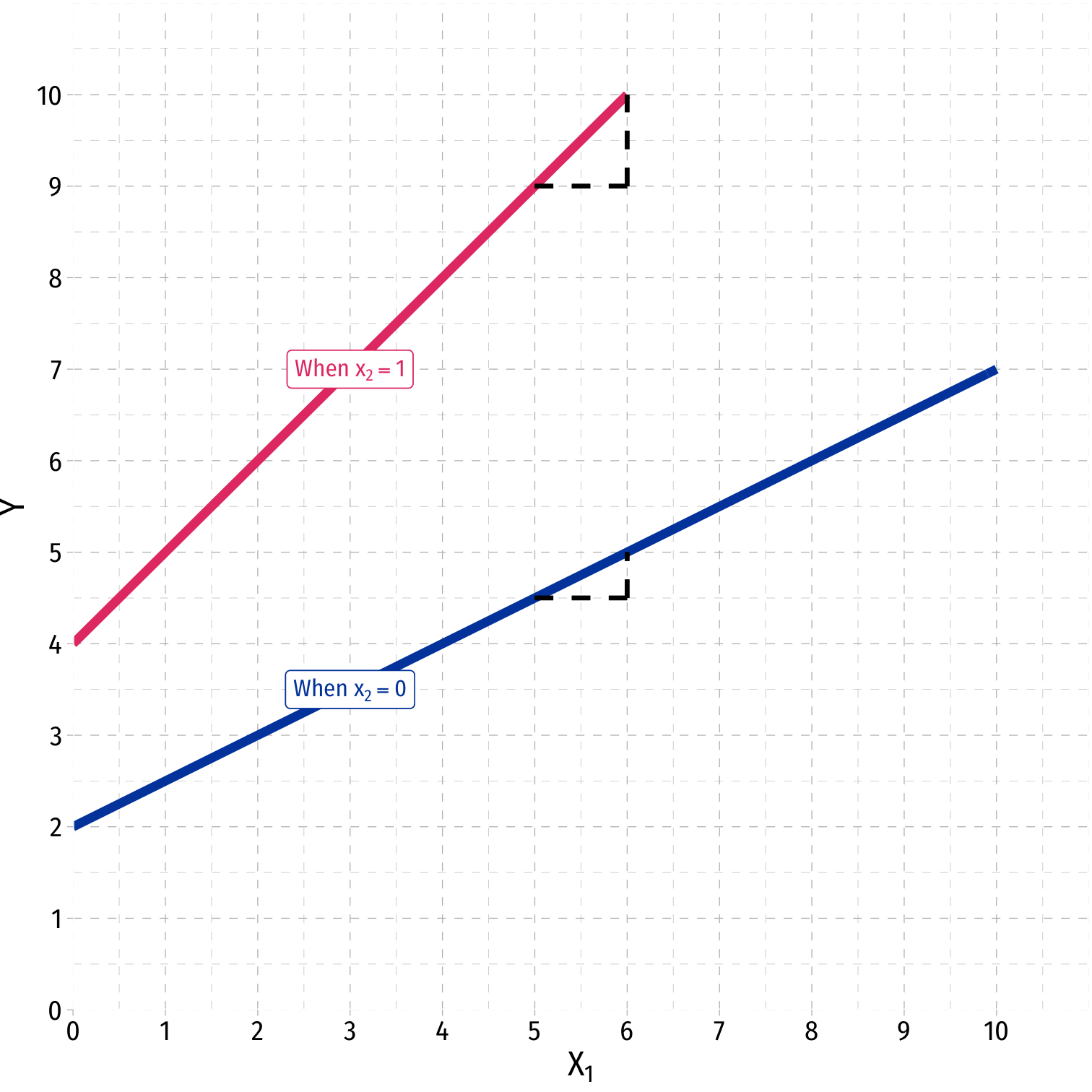

Sources of Nonlinearities III

Interaction Effect: ˆY=^β0+^β1X1+^β2X2+^β3X1×X2

Marginal effect, “slope” depends on the value of X2!

Easy example: if X2 is a dummy variable:

- X2=0 (control) vs. X2=1 (treatment)

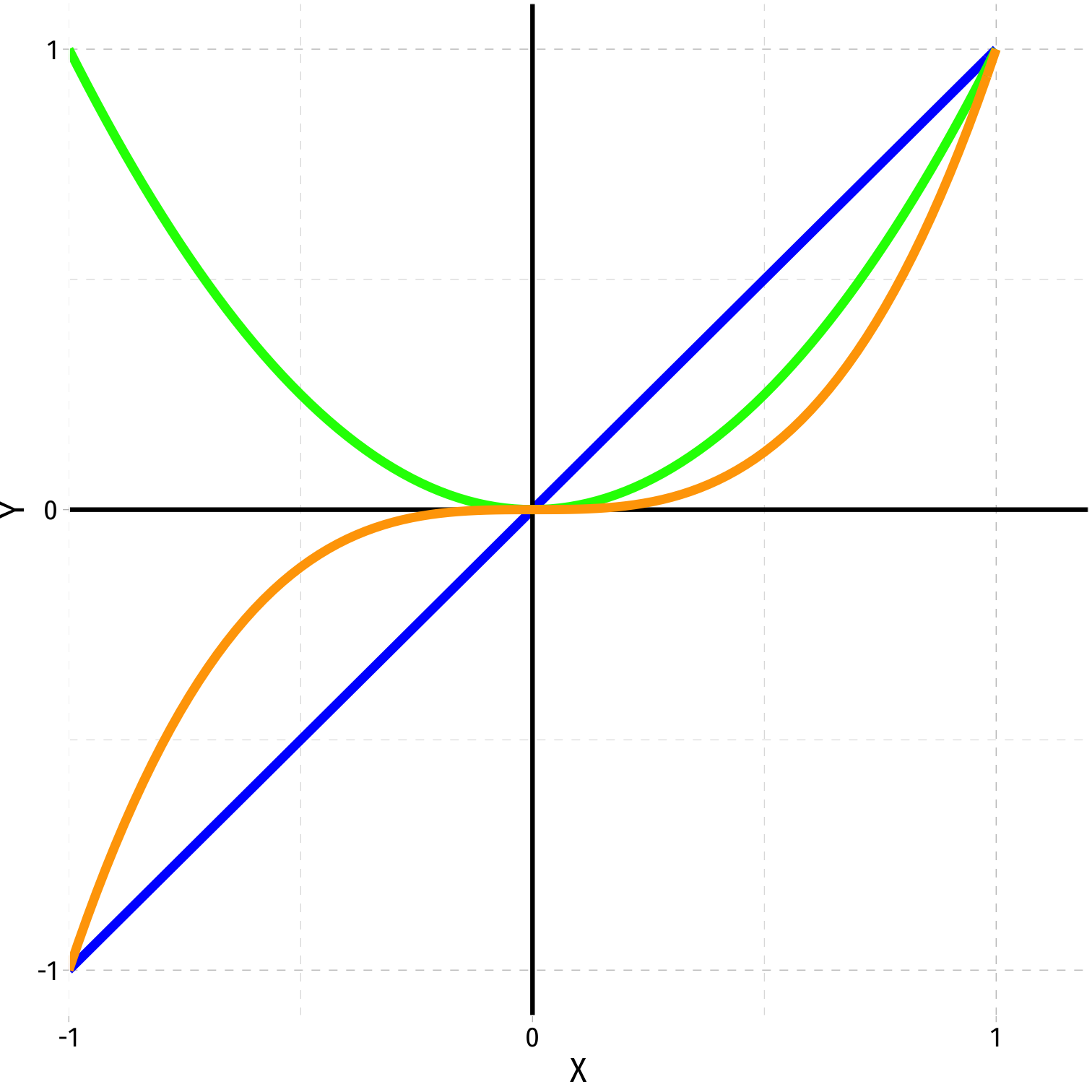

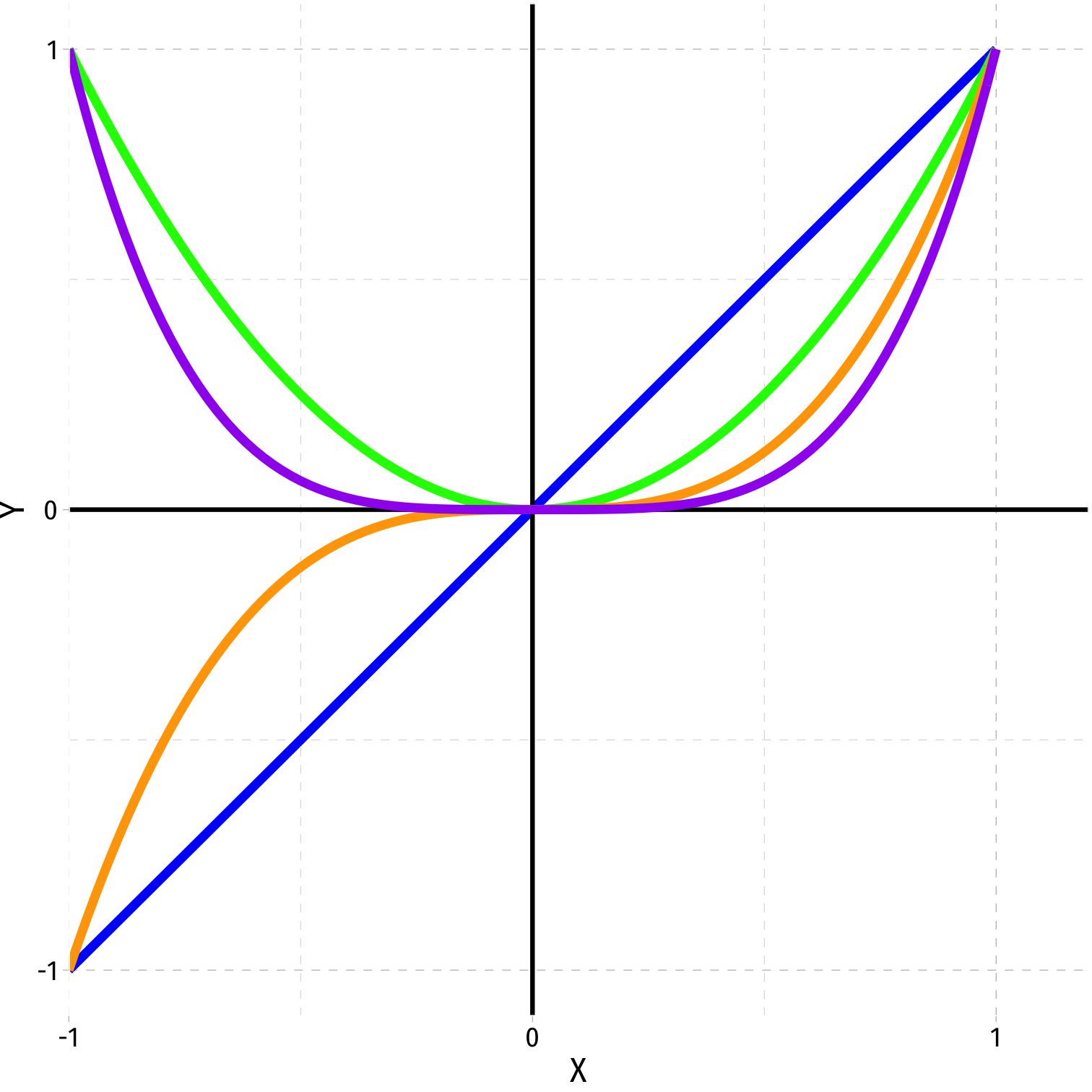

Polynomial Functions of X I

- Linear

ˆY=^β0+^β1X

Polynomial Functions of X I

- Linear

ˆY=^β0+^β1X

- Quadratic

ˆY=^β0+^β1X+^β2X2

Polynomial Functions of X I

- Linear

ˆY=^β0+^β1X

- Quadratic

ˆY=^β0+^β1X+^β2X2

- Cubic

ˆY=^β0+^β1X+^β2X2+^β3X3

Polynomial Functions of X I

- Linear

ˆY=^β0+^β1X

- Quadratic

ˆY=^β0+^β1X+^β2X2

- Cubic

ˆY=^β0+^β1X+^β2X2+^β3X3

- Quartic

ˆY=^β0+^β1X+^β2X2+^β3X3+^β4X4

Polynomial Functions of X I

^Yi=^β0+^β1Xi+^β2X2i+⋯+^βrXri+ui

Polynomial Functions of X I

^Yi=^β0+^β1Xi+^β2X2i+⋯+^βrXri+ui

- Where r is the highest power Xi is raised to

- quadratic r=2

- cubic r=3

Polynomial Functions of X I

^Yi=^β0+^β1Xi+^β2X2i+⋯+^βrXri+ui

Where r is the highest power Xi is raised to

- quadratic r=2

- cubic r=3

The graph of an rth-degree polynomial function has (r−1) bends

Polynomial Functions of X I

^Yi=^β0+^β1Xi+^β2X2i+⋯+^βrXri+ui

Where r is the highest power Xi is raised to

- quadratic r=2

- cubic r=3

The graph of an rth-degree polynomial function has (r−1) bends

Just another multivariate OLS regression model!

The Quadratic Model

Quadratic Model

^Yi=^β0+^β1Xi+^β2X2i

- Quadratic model has X and X2 variables in it (yes, need both!)

Quadratic Model

^Yi=^β0+^β1Xi+^β2X2i

Quadratic model has X and X2 variables in it (yes, need both!)

How to interpret coefficients (betas)?

- β0 as “intercept” and β1 as “slope” makes no sense 🧐

- β1 as effect Xi→Yi holding X2i constant??†

† Note: this is not a perfect multicollinearity problem! Correlation only measures linear relationships!

Quadratic Model

^Yi=^β0+^β1Xi+^β2X2i

Quadratic model has X and X2 variables in it (yes, need both!)

How to interpret coefficients (betas)?

- β0 as “intercept” and β1 as “slope” makes no sense 🧐

- β1 as effect Xi→Yi holding X2i constant??†

† Note: this is not a perfect multicollinearity problem! Correlation only measures linear relationships!

- Estimate marginal effects by calculating predicted ^Yi for different levels of Xi

Quadratic Model: Calculating Marginal Effects

^Yi=^β0+^β1Xi+^β2X2i

- What is the marginal effect of ΔXi→ΔYi?

Quadratic Model: Calculating Marginal Effects

^Yi=^β0+^β1Xi+^β2X2i

What is the marginal effect of ΔXi→ΔYi?

Take the derivative of Yi with respect to Xi: ∂Yi∂Xi=^β1+2^β2Xi

Quadratic Model: Calculating Marginal Effects

^Yi=^β0+^β1Xi+^β2X2i

What is the marginal effect of ΔXi→ΔYi?

Take the derivative of Yi with respect to Xi: ∂Yi∂Xi=^β1+2^β2Xi

Marginal effect of a 1 unit change in Xi is a (^β1+2^β2Xi) unit change in Y

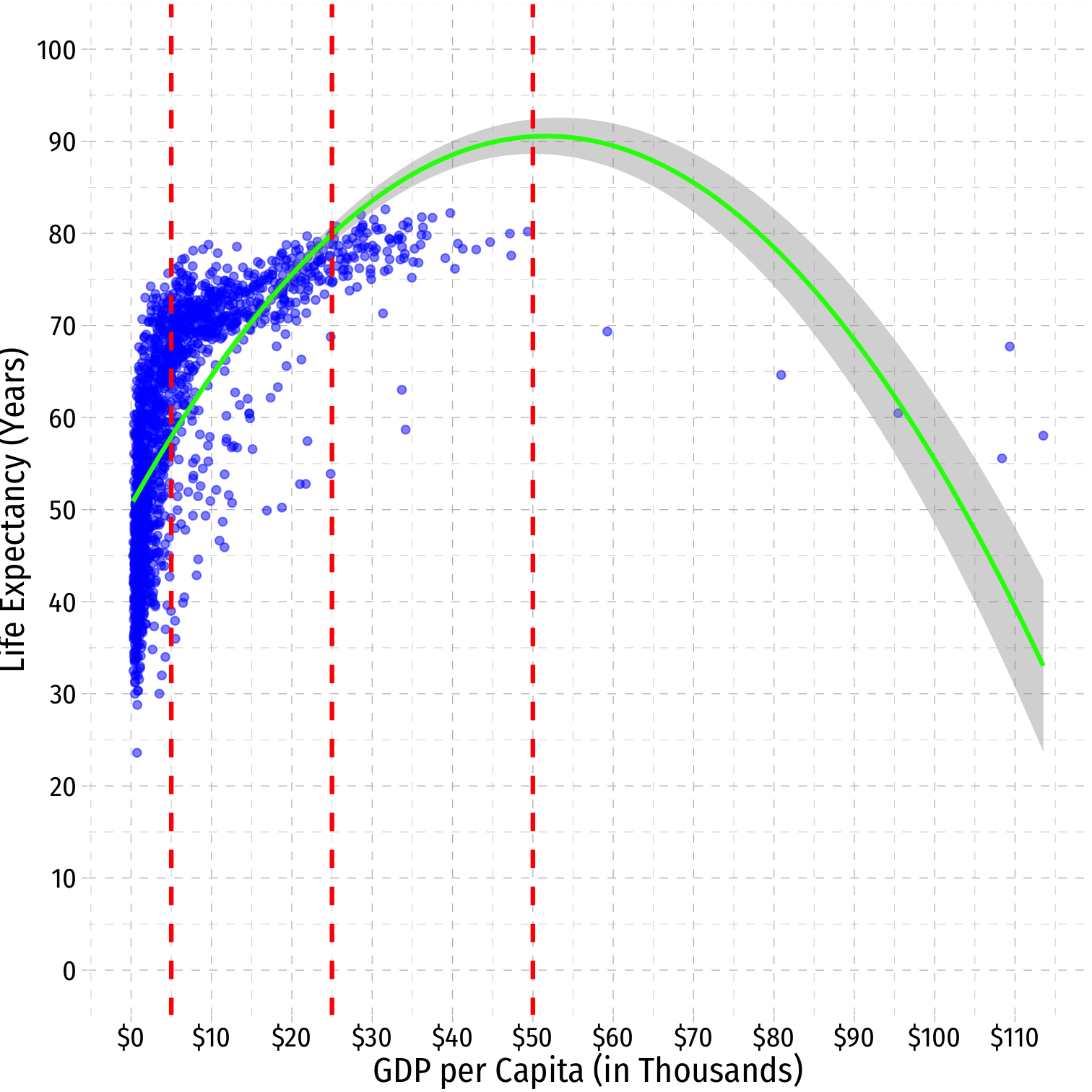

Quadratic Model: Example I

Example: ^Life Expectancyi=^β0+^β1GDP per capitai+^β2GDP per capita2i

- Use

gapminderpackage and data

library(gapminder)Quadratic Model: Example II

- These coefficients will be very large, so let's transform

gdpPercapto be in $1,000's

gapminder <- gapminder %>% mutate(GDP_t = gdpPercap/1000)gapminder %>% head() # look at it| ABCDEFGHIJ0123456789 |

country <fctr> | continent <fctr> | year <int> | lifeExp <dbl> | pop <int> | gdpPercap <dbl> | GDP_t <dbl> |

|---|---|---|---|---|---|---|

| Afghanistan | Asia | 1952 | 28.801 | 8425333 | 779.4453 | 0.7794453 |

| Afghanistan | Asia | 1957 | 30.332 | 9240934 | 820.8530 | 0.8208530 |

| Afghanistan | Asia | 1962 | 31.997 | 10267083 | 853.1007 | 0.8531007 |

| Afghanistan | Asia | 1967 | 34.020 | 11537966 | 836.1971 | 0.8361971 |

| Afghanistan | Asia | 1972 | 36.088 | 13079460 | 739.9811 | 0.7399811 |

| Afghanistan | Asia | 1977 | 38.438 | 14880372 | 786.1134 | 0.7861134 |

Quadratic Model: Example III

- Let’s also create a squared term,

gdp_sq

gapminder <- gapminder %>% mutate(GDP_sq = GDP_t^2)gapminder %>% head() # look at it| ABCDEFGHIJ0123456789 |

country <fctr> | continent <fctr> | year <int> | lifeExp <dbl> | pop <int> | gdpPercap <dbl> | GDP_t <dbl> | |

|---|---|---|---|---|---|---|---|

| Afghanistan | Asia | 1952 | 28.801 | 8425333 | 779.4453 | 0.7794453 | |

| Afghanistan | Asia | 1957 | 30.332 | 9240934 | 820.8530 | 0.8208530 | |

| Afghanistan | Asia | 1962 | 31.997 | 10267083 | 853.1007 | 0.8531007 | |

| Afghanistan | Asia | 1967 | 34.020 | 11537966 | 836.1971 | 0.8361971 | |

| Afghanistan | Asia | 1972 | 36.088 | 13079460 | 739.9811 | 0.7399811 | |

| Afghanistan | Asia | 1977 | 38.438 | 14880372 | 786.1134 | 0.7861134 |

Quadratic Model: Example IV

- Can “manually” run a multivariate regression with

GDP_tandGDP_sq

library(broom)reg1<-lm(lifeExp ~ GDP_t + GDP_sq, data = gapminder)reg1 %>% tidy()| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | 50.52400578 | 0.2978134673 | 169.64984 | 0.000000e+00 |

| GDP_t | 1.55099112 | 0.0373734945 | 41.49976 | 1.292863e-260 |

| GDP_sq | -0.01501927 | 0.0005794139 | -25.92149 | 3.935809e-125 |

Quadratic Model: Example V

- OR use

gdp_tand add the “transform” command in regression,I(gdp_t^2)

reg1_alt<-lm(lifeExp ~ GDP_t + I(GDP_t^2), data = gapminder)reg1_alt %>% tidy()| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | 50.52400578 | 0.2978134673 | 169.64984 | 0.000000e+00 |

| GDP_t | 1.55099112 | 0.0373734945 | 41.49976 | 1.292863e-260 |

| I(GDP_t^2) | -0.01501927 | 0.0005794139 | -25.92149 | 3.935809e-125 |

Quadratic Model: Example VI

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | 50.52400578 | 0.2978134673 | 169.64984 | 0.000000e+00 |

| GDP_t | 1.55099112 | 0.0373734945 | 41.49976 | 1.292863e-260 |

| GDP_sq | -0.01501927 | 0.0005794139 | -25.92149 | 3.935809e-125 |

Quadratic Model: Example VI

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | 50.52400578 | 0.2978134673 | 169.64984 | 0.000000e+00 |

| GDP_t | 1.55099112 | 0.0373734945 | 41.49976 | 1.292863e-260 |

| GDP_sq | -0.01501927 | 0.0005794139 | -25.92149 | 3.935809e-125 |

^Life Expectancyi=50.52+1.55GDP per capitai−0.02GDP per capita2i

Quadratic Model: Example VI

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | 50.52400578 | 0.2978134673 | 169.64984 | 0.000000e+00 |

| GDP_t | 1.55099112 | 0.0373734945 | 41.49976 | 1.292863e-260 |

| GDP_sq | -0.01501927 | 0.0005794139 | -25.92149 | 3.935809e-125 |

^Life Expectancyi=50.52+1.55GDP per capitai−0.02GDP per capita2i

Positive effect (^β1>0), with diminishing returns (^β2<0)

Effect on Life Expectancy of increasing GDP depends on initial value of GDP!

Quadratic Model: Example VII

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | 50.52400578 | 0.2978134673 | 169.64984 | 0.000000e+00 |

| GDP_t | 1.55099112 | 0.0373734945 | 41.49976 | 1.292863e-260 |

| GDP_sq | -0.01501927 | 0.0005794139 | -25.92149 | 3.935809e-125 |

- Marginal effect of GDP per capita on Life Expectancy:

Quadratic Model: Example VII

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | 50.52400578 | 0.2978134673 | 169.64984 | 0.000000e+00 |

| GDP_t | 1.55099112 | 0.0373734945 | 41.49976 | 1.292863e-260 |

| GDP_sq | -0.01501927 | 0.0005794139 | -25.92149 | 3.935809e-125 |

- Marginal effect of GDP per capita on Life Expectancy:

∂Y∂X=^β1+2^β2Xi∂Life Expectancy∂GDP≈1.55+2(−0.02)GDP≈1.55−0.04GDP

Quadratic Model: Example VIII

∂Life Expectancy∂GDP=1.55−0.04GDP

Marginal effect of GDP if GDP =5 ($ thousand):

∂Life Expectancy∂GDP=1.55−0.04GDP=1.55−0.04(5)=1.55−0.20=1.35

Quadratic Model: Example VIII

∂Life Expectancy∂GDP=1.55−0.04GDP

Marginal effect of GDP if GDP =5 ($ thousand):

∂Life Expectancy∂GDP=1.55−0.04GDP=1.55−0.04(5)=1.55−0.20=1.35

- i.e. for every addition $1 (thousand) in GDP per capita, average life expectancy increases by 1.35 years

Quadratic Model: Example IX

∂Life Expectancy∂GDP=1.55−0.04GDP

Marginal effect of GDP if GDP =25 ($ thousand):

Quadratic Model: Example IX

∂Life Expectancy∂GDP=1.55−0.04GDP

Marginal effect of GDP if GDP =25 ($ thousand):

∂Life Expectancy∂GDP=1.55−0.04GDP=1.55−0.04(25)=1.55−1.00=0.55

Quadratic Model: Example IX

∂Life Expectancy∂GDP=1.55−0.04GDP

Marginal effect of GDP if GDP =25 ($ thousand):

∂Life Expectancy∂GDP=1.55−0.04GDP=1.55−0.04(25)=1.55−1.00=0.55

- i.e. for every addition $1 (thousand) in GDP per capita, average life expectancy increases by 0.55 years

Quadratic Model: Example X

∂Life Expectancy∂GDP=1.55−0.04GDP

Marginal effect of GDP if GDP =50 ($ thousand):

Quadratic Model: Example X

∂Life Expectancy∂GDP=1.55−0.04GDP

Marginal effect of GDP if GDP =50 ($ thousand):

∂Life Expectancy∂GDP=1.55−0.04GDP=1.55−0.04(50)=1.55−2.00=−0.45

Quadratic Model: Example X

∂Life Expectancy∂GDP=1.55−0.04GDP

Marginal effect of GDP if GDP =50 ($ thousand):

∂Life Expectancy∂GDP=1.55−0.04GDP=1.55−0.04(50)=1.55−2.00=−0.45

- i.e. for every addition $1 (thousand) in GDP per capita, average life expectancy decreases by 0.45 years

Quadratic Model: Example XI

^Life Expectancyi=50.52+1.55GDP per capitai−0.02GDP per capita2i∂Life ExpectancydGDP=1.55−0.04GDP

| Initial GDP per capita | Marginal Effect† |

|---|---|

| $5,000 | 1.35 years |

| $25,000 | 0.55 years |

| $50,000 | −0.45 years |

† Of +$1,000 GDP/capita on Life Expectancy.

Quadratic Model: Example XII

ggplot(data = gapminder)+ aes(x = GDP_t, y = lifeExp)+ geom_point(color="blue", alpha=0.5)+ stat_smooth(method = "lm", formula = y ~ x + I(x^2), color="green")+ geom_vline(xintercept=c(5,25,50), linetype="dashed", color="red", size = 1)+ scale_x_continuous(labels=scales::dollar, breaks=seq(0,120,10))+ scale_y_continuous(breaks=seq(0,100,10), limits=c(0,100))+ labs(x = "GDP per Capita (in Thousands)", y = "Life Expectancy (Years)")+ ggthemes::theme_pander(base_family = "Fira Sans Condensed", base_size=16)

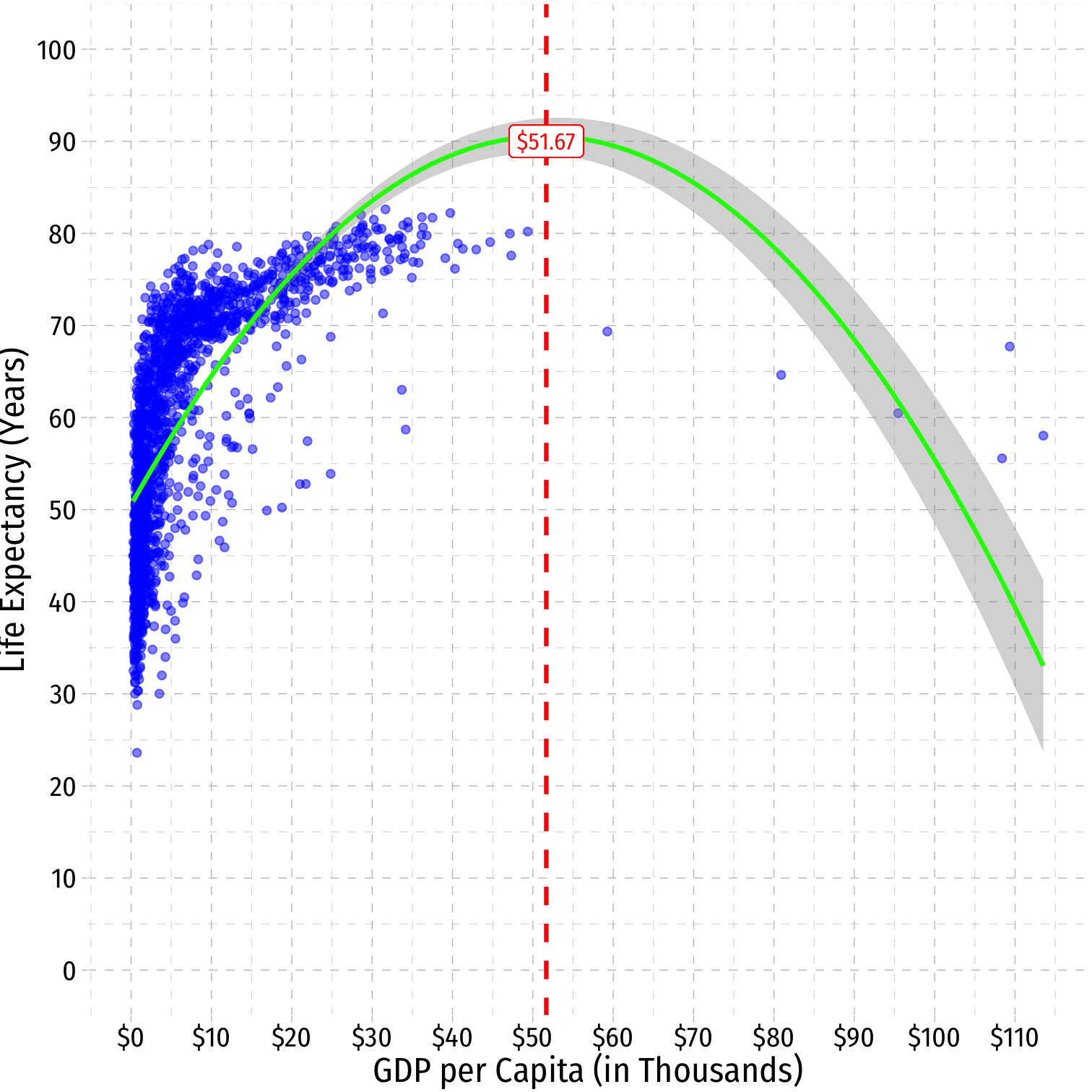

The Quadratic Model: Maxima and Minima

Quadratic Model: Maxima and Minima I

- For a polynomial model, we can also find the predicted maximum or minimum of ^Yi

Quadratic Model: Maxima and Minima I

For a polynomial model, we can also find the predicted maximum or minimum of ^Yi

A quadratic model has a single global maximum or minimum (1 bend)

Quadratic Model: Maxima and Minima I

For a polynomial model, we can also find the predicted maximum or minimum of ^Yi

A quadratic model has a single global maximum or minimum (1 bend)

By calculus, a minimum or maximum occurs where:

∂Yi∂Xi=0β1+2β2Xi=02β2Xi=−β1X∗i=−β12β2

Quadratic Model: Maxima and Minima II

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | 50.52400578 | 0.2978134673 | |

| GDP_t | 1.55099112 | 0.0373734945 | |

| GDP_sq | -0.01501927 | 0.0005794139 |

Quadratic Model: Maxima and Minima II

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | 50.52400578 | 0.2978134673 | |

| GDP_t | 1.55099112 | 0.0373734945 | |

| GDP_sq | -0.01501927 | 0.0005794139 |

GDP∗i=−β12β2GDP∗i=−(1.55)2(−0.015)GDP∗i≈51.67

Quadratic Model: Maxima and Minima III

ggplot(data = gapminder)+ aes(x = GDP_t, y = lifeExp)+ geom_point(color="blue", alpha=0.5)+ stat_smooth(method = "lm", formula = y ~ x + I(x^2), color="green")+ geom_vline(xintercept=51.67, linetype="dashed", color="red", size = 1)+ geom_label(x=51.67, y=90, label="$51.67", color="red")+ scale_x_continuous(labels=scales::dollar, breaks=seq(0,120,10))+ scale_y_continuous(breaks=seq(0,100,10), limits=c(0,100))+ labs(x = "GDP per Capita (in Thousands)", y = "Life Expectancy (Years)")+ ggthemes::theme_pander(base_family = "Fira Sans Condensed", base_size=16)

Are Polynomials Necessary?

Determining Polynomials are Necessary I

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | 50.52400578 | 0.2978134673 | 169.64984 | 0.000000e+00 |

| GDP_t | 1.55099112 | 0.0373734945 | 41.49976 | 1.292863e-260 |

| GDP_sq | -0.01501927 | 0.0005794139 | -25.92149 | 3.935809e-125 |

- Is the quadratic term necessary?

Determining Polynomials are Necessary I

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | 50.52400578 | 0.2978134673 | 169.64984 | 0.000000e+00 |

| GDP_t | 1.55099112 | 0.0373734945 | 41.49976 | 1.292863e-260 |

| GDP_sq | -0.01501927 | 0.0005794139 | -25.92149 | 3.935809e-125 |

- Is the quadratic term necessary?

- Determine if ^β2 (on X2i) is statistically significant:

- H0:^β2=0

- Ha:^β2≠0

Determining Polynomials are Necessary I

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> |

|---|---|---|---|---|

| (Intercept) | 50.52400578 | 0.2978134673 | 169.64984 | 0.000000e+00 |

| GDP_t | 1.55099112 | 0.0373734945 | 41.49976 | 1.292863e-260 |

| GDP_sq | -0.01501927 | 0.0005794139 | -25.92149 | 3.935809e-125 |

- Is the quadratic term necessary?

- Determine if ^β2 (on X2i) is statistically significant:

- H0:^β2=0

- Ha:^β2≠0

- Statistically significant ⟹ we should keep the quadratic model

- If we only ran a linear model, it would be incorrect!

Determining Polynomials are Necessary II

- Should we keep going up in polynomials?

^Life Expectancyi=^β0+^β1GDPi+^β2GDP2i+^β3GDP3i

Determining Polynomials are Necessary III

In general, you should have a compelling theoretical reason why data or relationships should “change direction” multiple times

Or clear data patterns that have multiple “bends”

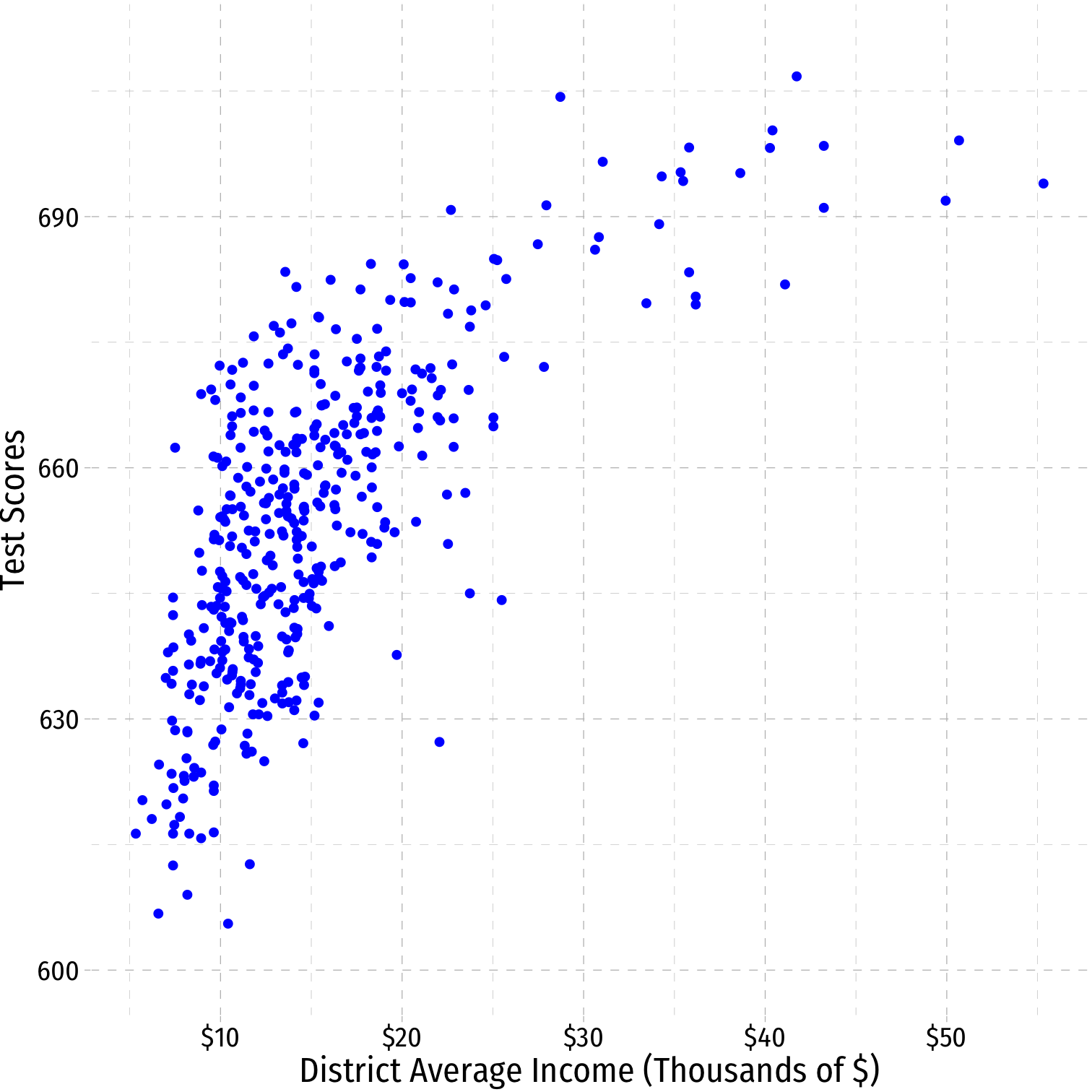

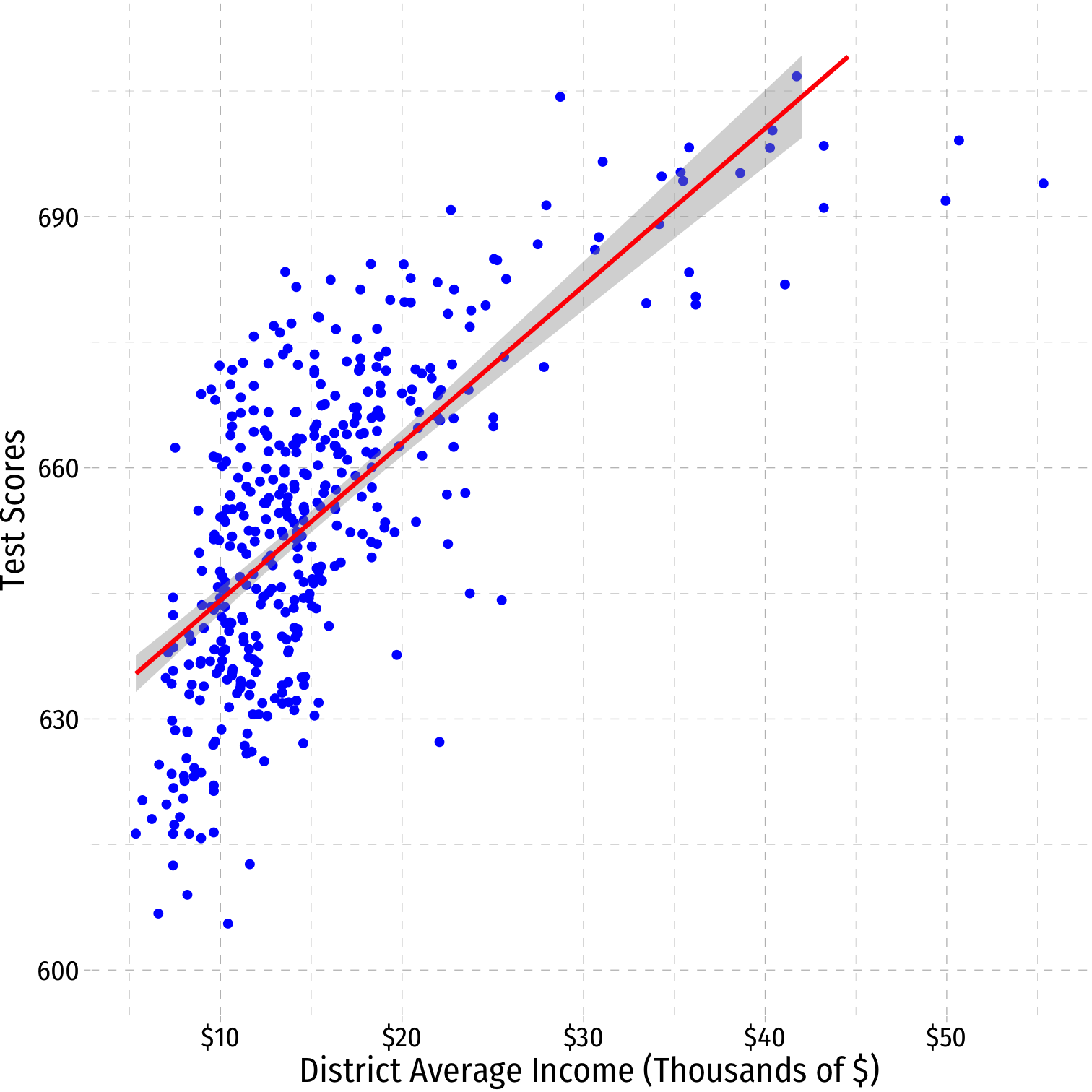

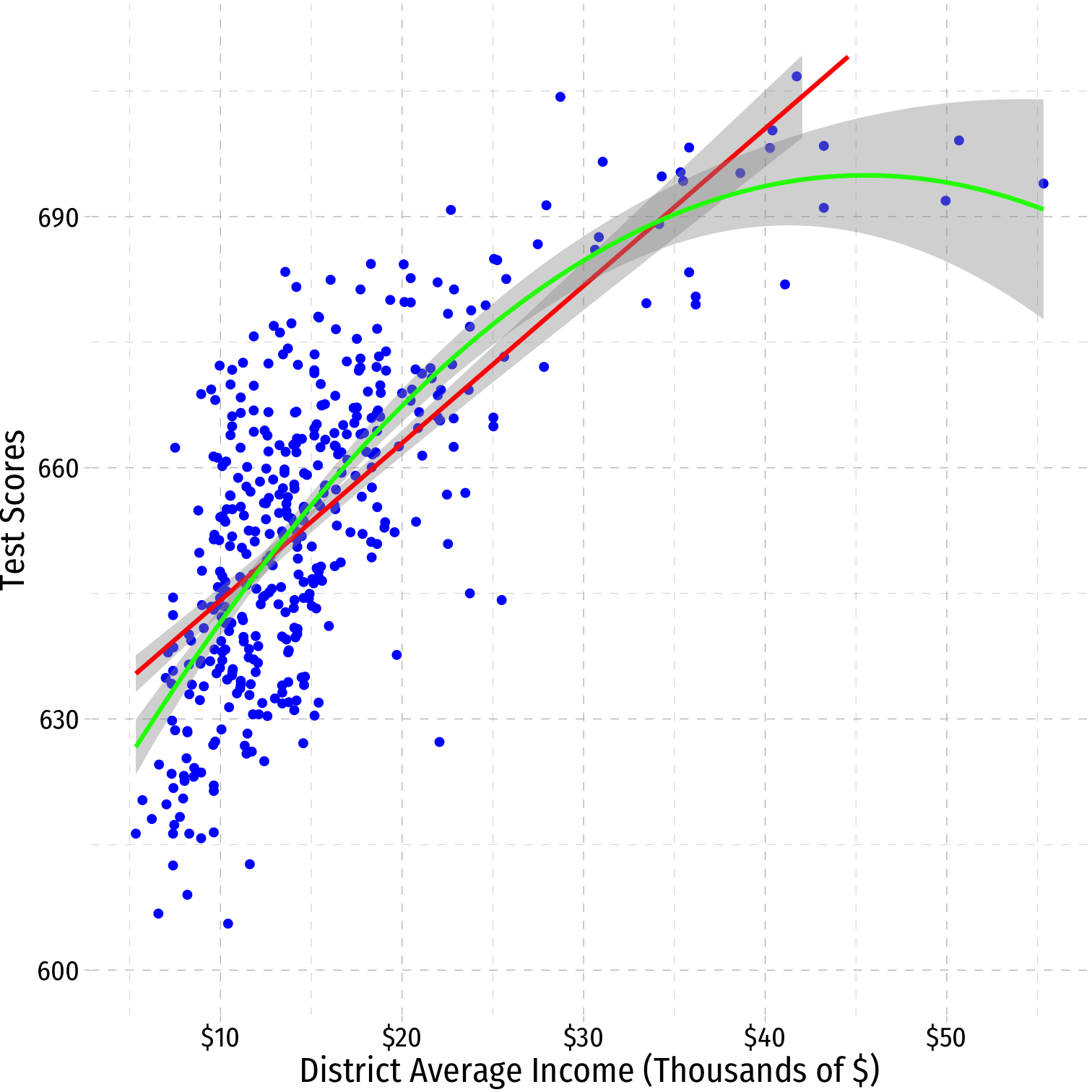

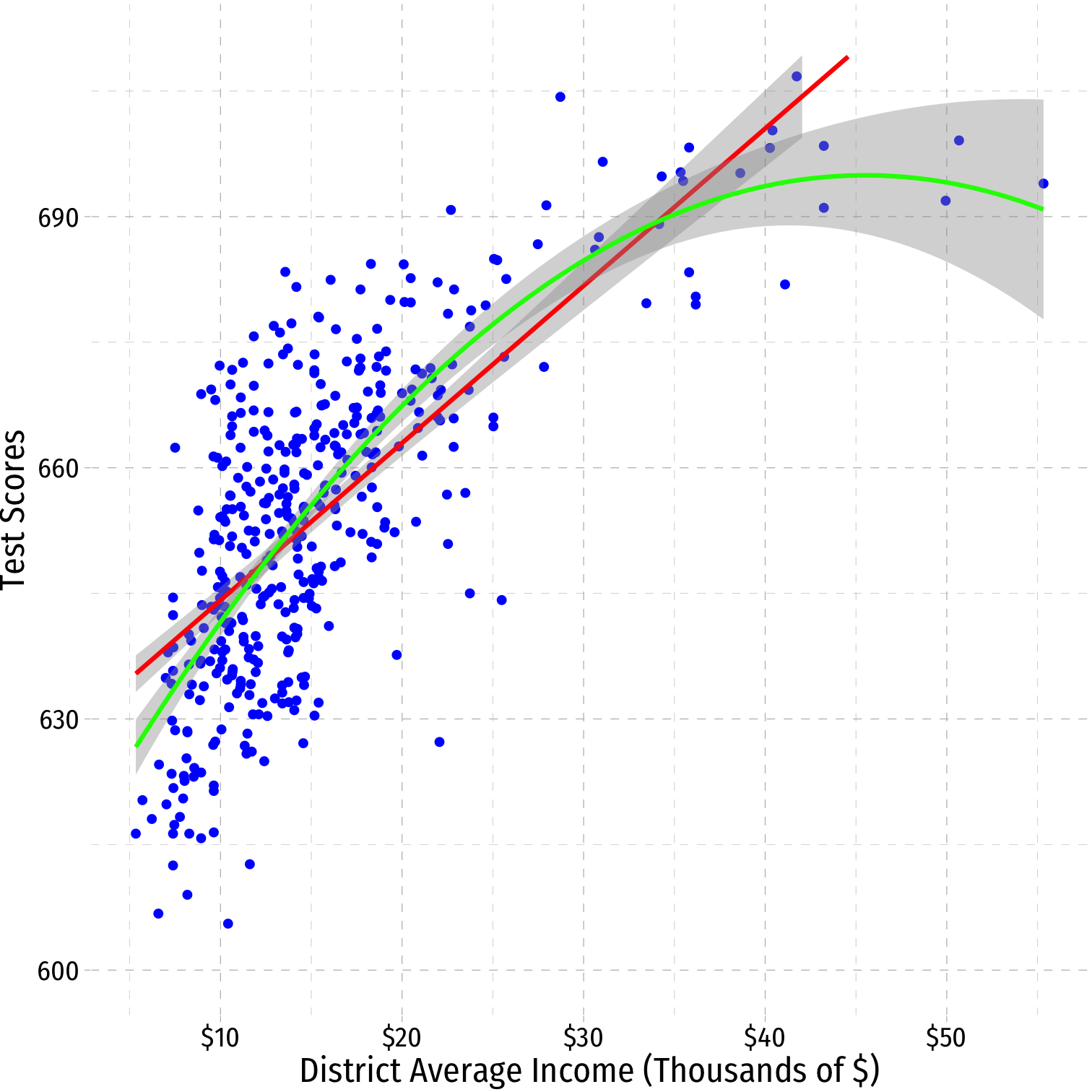

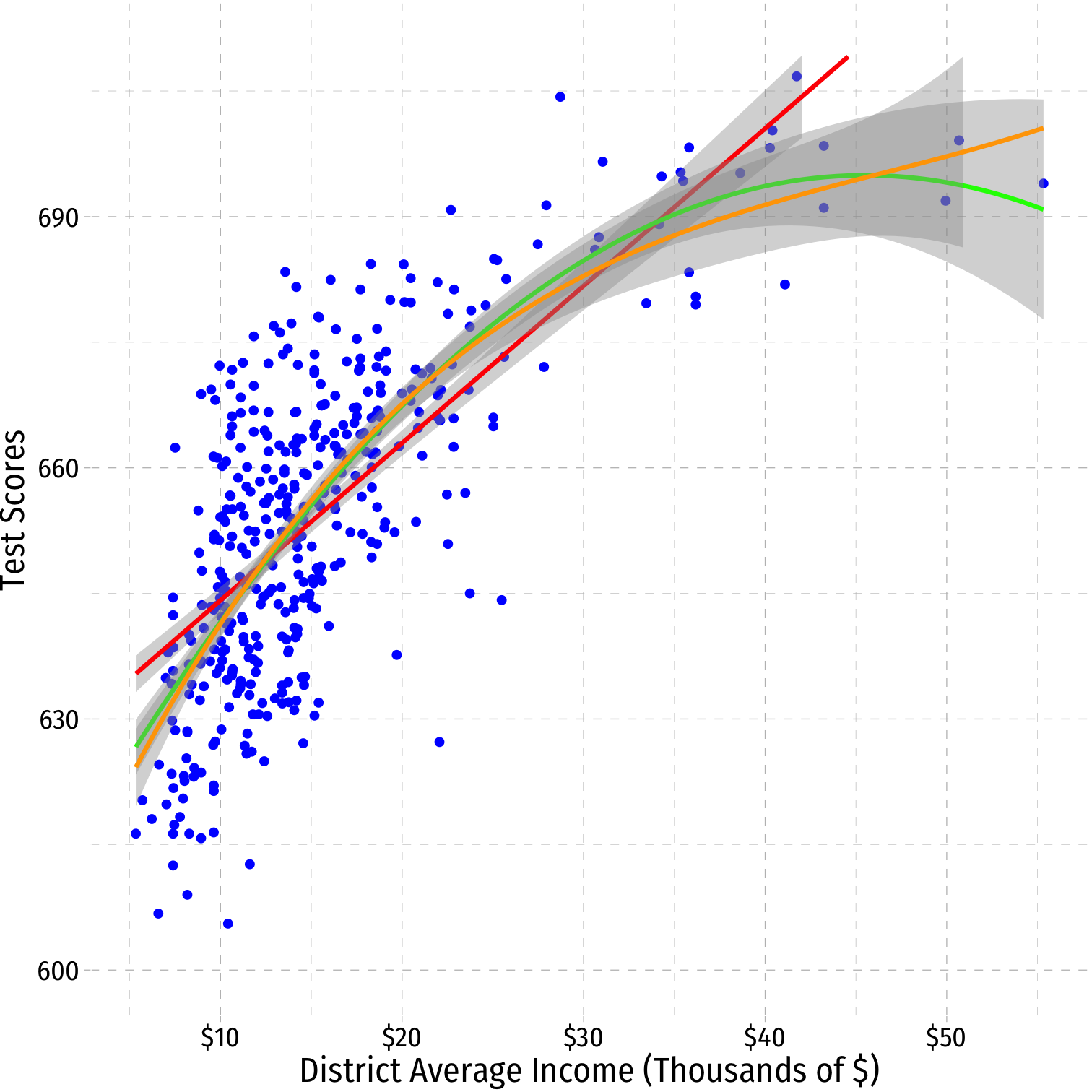

A Second Polynomial Example I

Example: How does a school district's average income affect Test scores?

A Second Polynomial Example I

Example: How does a school district's average income affect Test scores?

^Test Scorei=^β0+^β1Incomei

A Second Polynomial Example I

Example: How does a school district's average income affect Test scores?

^Test Scorei=^β0+^β1Incomei+^β1Income2i

A Second Polynomial Example II

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | |

|---|---|---|---|---|

| (Intercept) | 607.30173501 | 3.046219282 | 199.362449 | |

| avginc | 3.85099474 | 0.304261693 | 12.656850 | |

| I(avginc^2) | -0.04230846 | 0.006260061 | -6.758474 |

A Second Polynomial Example III

| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | 6.000790e+02 | 5.8295880342 | |

| avginc | 5.018677e+00 | 0.8594537744 | |

| I(avginc^2) | -9.580515e-02 | 0.0373591998 | |

| I(avginc^3) | 6.854842e-04 | 0.0004719549 |

- Should we keep going?

Strategy for Polynomial Model Specification

- Are there good theoretical reasons for relationships changing (e.g. increasing/decreasing returns)?

Strategy for Polynomial Model Specification

Are there good theoretical reasons for relationships changing (e.g. increasing/decreasing returns)?

Plot your data: does a straight line fit well enough?

Strategy for Polynomial Model Specification

Are there good theoretical reasons for relationships changing (e.g. increasing/decreasing returns)?

Plot your data: does a straight line fit well enough?

Specify a polynomial function of a higher power (start with 2) and estimate OLS regression

Strategy for Polynomial Model Specification

Are there good theoretical reasons for relationships changing (e.g. increasing/decreasing returns)?

Plot your data: does a straight line fit well enough?

Specify a polynomial function of a higher power (start with 2) and estimate OLS regression

Use t-test to determine if higher-power term is significant

Strategy for Polynomial Model Specification

Are there good theoretical reasons for relationships changing (e.g. increasing/decreasing returns)?

Plot your data: does a straight line fit well enough?

Specify a polynomial function of a higher power (start with 2) and estimate OLS regression

Use t-test to determine if higher-power term is significant

Interpret effect of change in X on Y

Strategy for Polynomial Model Specification

Are there good theoretical reasons for relationships changing (e.g. increasing/decreasing returns)?

Plot your data: does a straight line fit well enough?

Specify a polynomial function of a higher power (start with 2) and estimate OLS regression

Use t-test to determine if higher-power term is significant

Interpret effect of change in X on Y

Repeat steps 3-5 as necessary